The ECB Will Set Thursday’s Option Trading Tone!

Yesterday, "Super Tuesday" turned into "Super Bearish Tuesday”. Overnight, European stocks were down on worries that the subprime crisis has spread across the pond and major banks were down 4% on average.

Before the open, a very weak ISM services number was prematurely leaked out ahead of its official release. This number does not normally pack much punch, however it was materially weaker than expected.

This morning, European stocks were generally flat and that gave the market a little support. Decent earnings from Disney also helped. The Asian markets did not fare so well. The Hang Seng and Nikkei were both down 5% overnight. Chinese investors have to be nervous since their markets are closed until February 13th.

After the close today, we will hear from Cisco. The stock has been beaten down and the CEO has been optimistic. If they can post a solid number, there is a chance for a small tech bounce. For that to happen, we will need help from Europe.

Tomorrow, the ECB will meet. They will release their minutes and disclose their stance on interest rates. I believe the market has priced in a hawkish bias. They have been steadfast in maintaining rates they are concerned with inflation. If they're bias changes, the market could have a positive response. However, if they stay unaccommodative, the market will drop on the notion that their policy will push Europe into a recession.

In addition, Deutsche Bank releases earnings. Those numbers will be dissected and investors will determine if the subprime mess has spread to Europe.

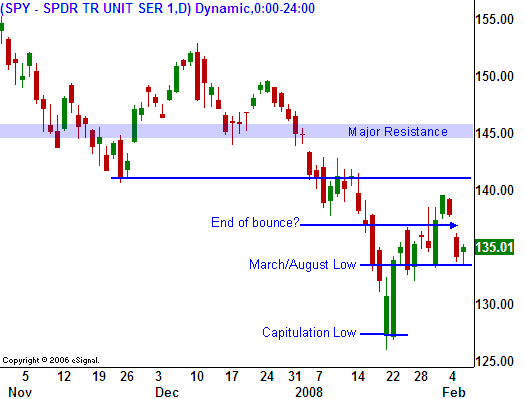

I did not like yesterday's selloff and the market is resting on a horizontal support level. I believe we will see a positive reaction to Cisco's earnings, but that rally will take a back seat to the ECB and Deutsche Bank. If there is any positive news out of Europe, we might be able to make back some of the losses we've seen in the last two days. If Deutsche Bank has massive write-downs and the ECB stands pat, we will break below the SPY 134 support level and bears will try to test the lows from two weeks ago.

I do not trust this early rally today and the market does not feel like it will add to the gains. The gap down yesterday may have marked the end of a very shallow market bounce. This afternoon we could see a selloff into the bell. Fear is the dominant emotion and investors are in shoot first, ask questions later mode.

Daily Bulletin Continues...