Weak Data Could Spell Trouble This Week

This market looks like it is going to test the lows from January. Good news is almost impossible to find as economic numbers keep showing weakness. Today the ISM manufacturing number came in slightly better than expected – but it was still weak.

Last week, the GDP and durable goods numbers weighed on the market. Those two releases came on the heels of a very hot PPI report.

Tomorrow, we will get the ADP employment index. Jobless claims have been picking up over the last few weeks and I am not expecting a good number. Later in the week, the Beige Book will be released and it will reveal economic activity across the nation. The most important number of all is the Unemployment Report (Friday). Rising unemployment, weakening economic conditions, a credit crisis and hot inflation are a dangerous mix.

Fed rate cuts have been larger and they have barely kept the market afloat. At this pace the Fed will quickly run out of bullets.

The capitalization for troubled bond insurers briefly supported the market a week ago; however, the Ambac deal has run into snags.

Europe was down roughly 1%, Japan was down 4%, and Hong Kong was down 3%. China was the exception and it finished 2% higher. European economic activity is slowing and the ECB is maintaining its hawkish stance. The Nikkei is down almost 25% since its December high of 18700. The decoupling theory (where the rest of the world prospers during our recession) is showing signs of strain.

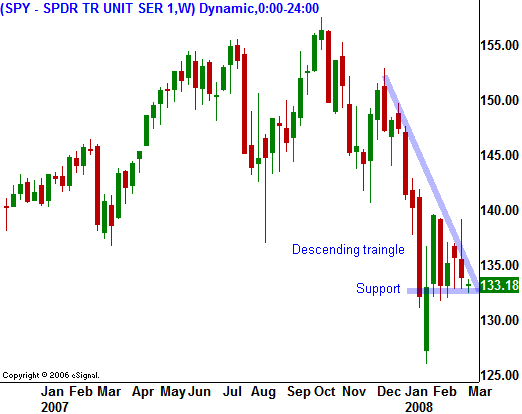

In today's chart I used a weekly chart to display recent price action. As you can see, a descending triangle has formed. Each market rally has been met by early resistance as sellers have become more aggressive. This has resulted in a series of lower highs. The support level is being tested with greater frequency and it is likely to give way.

I thought we might see a decent rally off of an oversold condition and now I question that forecast. The rally was just getting started last Tuesday and then it completely fizzled. This wimpy attempt at a bounce tells me the sellers are still in control.

Take profits on commodity stocks. I believe dismal economic releases will weigh on the market this week. Aggressive traders might want to line up shorts. Retail and financial stocks are the first place to look.

Daily Bulletin Continues...