Stock Market Breaks Key Support Due To Write-downs and Foreclosures.

Yesterday, the stock market was able to stage a nice rally. News that Ambac was close to securing its AAA credit rating temporarily restored confidence. However, once the details were outlined, the market was less enthusiastic and the stock finished lower. This morning we learned that Thornburg missed a payment. Lenders, insurers and banks are taking major heat this morning.

The Beige Book was also released yesterday. It showed weakening economic conditions across the nation. Eight of the 12 districts reported weaker business activity.

This morning, we learned that foreclosures hit another record high. The percentage of loans in the foreclosure process was 2.04% of all outstanding loans. That is up from 1.69% in the previous quarter and 1.19% a year ago. Delinquencies in the fourth quarter reach a level not seen since 1985. The seasonally adjusted delinquency rate for mortgages was 5.82% of all loans outstanding in the fourth quarter. That was up from 5.59% in the previous quarter and 4.95% a year ago.

The key to foreclosures and delinquencies is employment. If homeowners keep their jobs, the problem can correct itself over time. On the other hand, if the Unemployment Report tomorrow shows higher than expected job loss, the mortgage crisis could worsen substantially.

This morning, the jobless claims number came in better-than-expected. The ADP employment index showed that nonfarm payrolls grew by 2000 last month. That was much weaker than analysts had expected, however, this report is not that accurate. During two of the last three months, ADP has over-estimated the employment rate. The consensus growth estimate for tomorrow's nonfarm payrolls is 25,000. If the ADP report is any indication of what's to come, we could be in for a weak number.

On a positive note, retail sales came in stronger than expected. Same-store sales in February rose 2% and that compares to .3% in January and less than 1% in December.

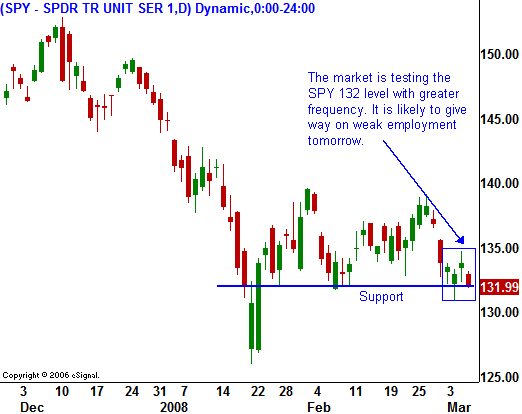

As I've been pointing out in my charts, the market has been drifting down to test support at the SPY 132 level with greater frequency. I feel like it is hanging on by its finger nails as it desperately looks for any good news. Tomorrow's Unemployment Report has the potential to swing this market either way.

Solid employment will ease some of the foreclosure worries and it will mean that consumers are still able to tread water. On the other hand, weakening employment conditions would cause another round of panic selling and the lows from January would be tested. Investors are nervous and Trim Tabs reported an unprecedented outflow from equities in February that averaged $2B per day.

That could be a contrary indicator. If you follow that thought, 12 major investment magazines featured cover stories on the bear market. Coverage of that magnitude has been a fairly good indicator of a market bottom in the past. Either way, I will let the market show me the way.

The best trading strategy is to go long commodities and short financials depending on the market’s reaction to the number tomorrow. If I had to guess, we are headed lower.

Daily Bulletin Continues...