Let This Rally Run Its Course and Then Buy Puts.

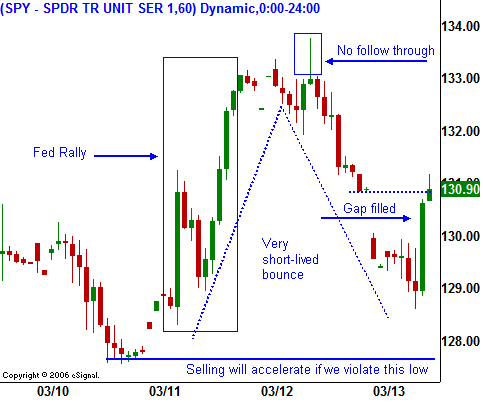

Tuesday, the stock market gapped higher on the open creating an option trading opportunity. It staged the largest one day rally in over five years. The Fed paved the way by offering primary dealers access to $400 billion in US treasuries. On a short-term basis, the Fed would accept AAA rated mortgages as collateral for a loan. I view this as nothing more than a bridge loan to help banks through a difficult period.

Apparently, traders shared my view. The market tried to add to its gains early yesterday morning, but that move quickly failed. Throughout the course of the day the selling pressure increased and the market had given back much of its one-day gains.

Overnight, Asian markets were down by as much as 4% and Europe was down 2%. Retail sales sank by .6% in February. Over the last quarter, sales were down .1% compared to the prior quarter. Retail sales account for about one third of the GDP and I believe we are in a recession.

While the Fed’s action was helpful, it did not address the greater issue. Americans are behind on their debt and with a weakening economy, rising unemployment and higher inflation, the situation will get worse. Delinquencies and foreclosures on all outstanding mortgages have climbed to a 20-year high. This morning, Carlyle Capital announced that it is on the verge of collapse. The fund’s securities consist entirely of Fannie Mae and Freddie Mac mortgages, which supposedly carry a government guarantee.

The stock market was not able to add to its one-day rally and that is a bearish sign. As I mentioned yesterday, I did not believe that this rally was legitimate. I wanted to see natural buyers step in and support the market as it attempted to test a capitulation low from January. We never got a chance to see that level of buying commitment because the Fed created an artificial move. Yesterday, I also stated that if the market traded below SPY 132, it would be a shorting opportunity. I hope you took advantage of that breakdown.

This morning, the market has been able to claw its way back from a very negative opening. I feel that as the day wears on, the buyers will step back and the market will continue to head lower. There is too much negative news and we are on the verge of panic selling. I truly believe this market could have a meltdown.

I see tremendous values in the market and I look forward to a bona fide support level. At this juncture, margin calls and fear are driving the action. If traders are forced to liquidate positions, value won't mean a thing. They will have to sell whatever they can to get into cash. My favorite shorts are the financials, restaurants, healthcare and retail. Daily Report subscribers have over 40 extensively researched shorts to choose from. The weakest stocks will float right to the top of the Live Update table.

Daily Bulletin Continues...