Option Traders – Scale Into Call Positions – Don’t Get Too Agressive.

What a difference a day makes. Yesterday, after the close, we learned that Lehman was able to secure $3 billion of additional financing. Although it said it did not need the capital, it was addressing the market’s perception that solvency issues lurk.

Overnight, UBS announced aggressive write-downs ($19B) and it is issuing $15 billion in new equity to shore up its capital base. The bank is making a concerted effort to mark the end of its mortgage woes and the market liked the news. Deutsche Bank followed suit as it wrote down an additional $4 billion. A worst-case scenario has been built into these stocks and when the news wasn't as bad as expected, it served as a catalyst for financial stocks. This morning, we also learned that Thornburg Mortgage received a takeover bid.

In addition to all of the “positive” news from the financial sector (mind you, these are huge write downs), we also got a better than expected ISM manufacturing number. The ISM rose to 48.6% in March, up from 48.3% in February. That reading topped analyst’s expectations of 47.0%.

The market still has a number of hurdles it has to get through this week. All eyes will be fixed in on the Unemployment Report. Last week, initial jobless claims came in better than expected. If that trend continues this Thursday, there is a chance that the Unemployment Report will be benign. Given today's impetus, I think a flat number moves this market higher. It would take a large increase in unemployment to scare out the bottom pickers.

Take long positions, but don't reach for stocks and don't over commit capital at this stage. The news was not that good today; it’s just that horrible news was priced in. There will be retracements in this news driven market and those dips will present good buying opportunities. As the market works its way up to the SPY 140 level, take profits. That resistance level should hold well into the first two weeks of earnings (mainly banks releasing).

Tomorrow, we get the ADP employment index. It tends to overstate employment conditions, but most analysts are already aware of that. If the number meets expectations, we will see follow through to today's rally.

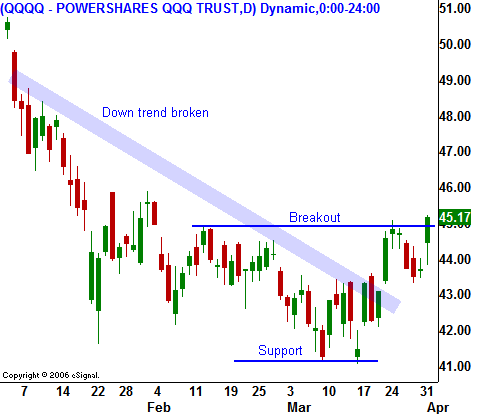

In yesterday's chart, I pointed out the nice base that tech stocks have formed. They shot higher right out of the gate today and I believe they represent a good trading opportunity. Look for stocks that have maintained long-term up trends and have weathered the market's recent decline. If those stocks have rallied today through a resistance level, they are probably good trading candidates.

Be prudent, and don't expect this market to come flying back. There will be many rallies and declines to trade him over the next two to three months.

Daily Bulletin Continues...