Option Traders – Reduce Call Positions Ahead of the Unemployment Report.

Today, there are plenty of crosscurrents to keep this market chopping back and forth ahead of the Unemployment Report.

Yesterday, the market was able to hold on to the huge gains from Tuesday. That's a positive since it has not been able to do that in the last two months. Every gain was followed by an equal sized declined.

Asian markets rallied last night and they provided a good springboard for our market. China and Japan have been in a free fall this year and time will tell if this is simply a bear market rally.

The earnings picture is mixed. Yesterday, RIMM announced better than expected results and the stock is trading higher today. On the negative side, GRMN lowered its outlook and Micron announced lower memory prices.

Before the open, the initial jobless claims number was released. It rose by 38,000 to reach 407, 000, the highest level since mid-September 2005. As I mentioned yesterday, the ADP employment index tends to overstate jobs (yhe bulls hope that is not the case this week). A rise in unemployment could wipe out this week's market gains. As a side note, Google is cutting about 300 jobs from the American operations of Double-Click and Dell is going to cut 9000 jobs.

The market did get some good news from the ISM services number this morning. It rose .2% and it stands just under 50. A number above 50 would indicate expansion in the services sector. Two months ago, a weak ISM services number buried the market.

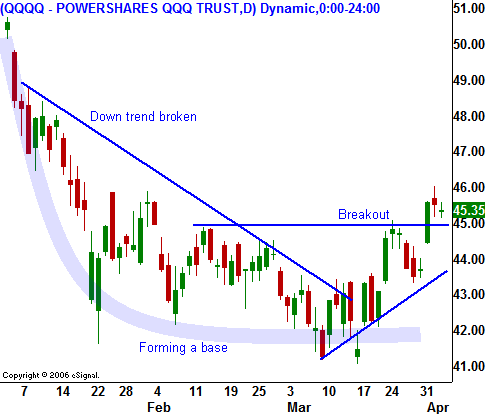

The chart today shows the nice base that tech stocks have formed. They have rallied off of the low, they have broken through a down trendline and they are above a minor resistance level. These are all positive signs. If the market is going to stage a sustained rally, it needs to find strength from this sector. It will not get a sustained move from financial stocks for at least three to four months. Financial stocks may have put in their lows for this year and at least they won’t be weighing down the market.

The market will continue to chop back and forth within a fairly wide trading range for the next few months. You have to buy near the low end of the range and take profits as the market tests the high end of the range. If the resistance level holds, start adding short positions. As the market declines, take profits near support levels. This is a trading pattern that could repeat through the summer.

For longer-term traders, I believe the best strategy is to buy the dips and take profits on the rallies. When the rally has exhausted itself, go to cash and wait for the next pullback. Commodity stocks have been the best play.

For today, I would keep positions very small. If you have long positions with nice profits, exit the trades and take your gains. There is no need to risk hard-earned money ahead of a big number tomorrow.

After today's weaker than expected initial jobless claims and after the Fed Chairman's comments this week about the likelihood of a recession, I feel there is a good chance that unemployment is on the rise. I don't like to gamble, but if I were going to, I would favor the downside tomorrow. I hope I'm wrong.

Daily Bulletin Continues...