Cash Is King Ahead of the Fed – Resume Option Trading After the FOMC.

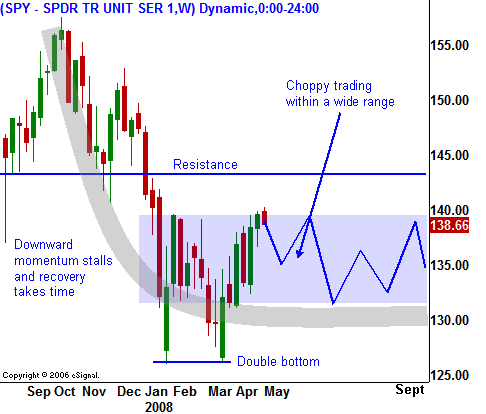

Yesterday, the market tried to break out above the SPY 140 resistance level. Merger news from Mars and Wrigley helped set a positive tone. By late afternoon, the momentum was gone.

This morning, large losses from Countrywide, declining home prices, rising foreclosures and a 5-year low in consumer confidence cast a dark cloud over the market. Prices have continued to drift lower.

This week will be filled with economic releases. Gloomy data will weigh on the market and traders will be reminded that we are not out of the woods yet. I will take my lead from the Fed’s decision and statements tomorrow.

If the FOMC lowers by .25% and they leave the door open for future rate cuts, I will short the ensuing rally once it stalls. This scenario tells me that they are still concerned about the fragile state of the economy and that the credit crisis still looms.

The more likely scenario is that the Fed will lower rates by a .25% and they will clearly state that this the rate cuts have ended. The market expects this and a 70% probability has been factored into bond prices. Nevertheless, a market decline is likely. We are right up on a resistance level and the move could gain momentum as buyers step back.

If the Fed does not lower rates, the market will sell off dramatically. Once the dust settles, traders will recognize this as a sign of strength. The Fed will not make such a bold move unless they are confident that the worst has passed. They will have taken Friday's Unemployment Report into consideration.

I had mentioned yesterday to take a small long position on the breakout. There was no follow through and ahead of the Fed; you should look for an exit point. Cash is king at this juncture.

Tomorrow, we will get the ADP employment index, GDP, the Chicago PMI and crude inventories. A word of caution, the ADP index tends to overstate employment. The consensus is a drop of 60,000 jobs. GDP is expected to come in at .5%. The market would be happy with this GDP number. Oil inventories could swing the market in either direction. It seems that we have reached a breaking point with regards to oil. It is biting heavily into discretionary spending and the President addressed that in his press meeting today.

I still favor the downside heading into Friday, but I would not short this move. Stay in cash and wait. Today, the momentum is down and I expect that move to continue with a small bounce off of the low late in the day. Commodity stocks are pulling back and we will have a great entry point soon.

Daily Bulletin Continues...