Your Future Shorts Are Not Rallying With The Market – Find Them.

Yesterday, the market rallied on a better than expected CPI number. A build in oil inventories created selling pressure in energy and that helped to spark a rally. As the day wore on, the market gradually gave back its gains. That was unusual given the bullish expiration bias. The market is near its one-month high and option expiration buy programs were goosing it higher. Those don't typically fail once they materialize.

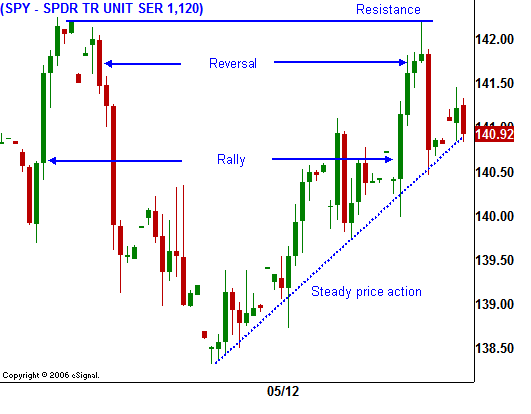

On a short-term basis, a resistance level has formed at SPY 142. With regard to yesterday's rally, the CPI did not accurately reflect inflation. As many analysts pointed out, the number depicted a 2% decline in fuel prices when in reality gasoline was up 11% during the month of April.

I feel that the market is getting tired, however, it continues to deflect the bad news that is thrown at. This morning, oil has bounced back to an all-time high on analyst upgrades and the market seems oblivious to the move. In fact, the recent market rally has occurred while oil has been surging higher. I don't believe that higher energy prices are going to break this market. Energy is a substantial part of the S&P 500 and these stocks are actually supporting the index. Many traders are taking comfort in higher oil prices because it means that global expansion is robust.

This morning, the Fed Chairman encouraged banks to continue raising capital. My interpretation is that the Fed won't believe hold out its hand much longer and banks need to get their act together now.. Rising inflation will prompt them to raise rates in the near future

Industrial production decreased by .7%. That was greater than expected and it is the biggest drop in nearly 3 years. Initial jobless claims increased by 6.000 and that was in line with expectations. Of concern is the 3 million plus continuing claims. This indicates that people who are collecting unemployment are staying on it. The Philly Fed index came in at a -15.6. That number was better than expected, but be aware that any number below zero represents contraction.

JC Penney released earnings this morning. Net income fell 50% and revenues were down 5%. Additionally, they lowered guidance for the next quarter. I feel that retail stocks will rollover this summer. Higher oil prices and weakening economic conditions will weigh on consumption. The comps will start getting easier, but that alone won't rally these stocks.

As you can see in today's chart, the market has hit resistance at SPY 142. In the last few days it has made a nice move higher. The path of least resistance is up and the higher we climb the more tenuous the rally. Momentum alone can carry this market higher during quiet period's. However, when a reversal comes, it will be fast and furious. Expiration should lend support to the market today. As we approach Memorial weekend, the price action should also stay positive. Trading is likely to quiet down and we can already see the VIX dropping.

The market is choosing to ignore the warning signs. I am starting to nibble on short positions. I am favoring stocks that have been in a long-term downtrend, have bounced with the market, and have hit resistance. As the market rallies, look for stocks that don't participate. I am also selling out of the money call credit spreads on similar stocks. If the market is able to get through SPY 145, I will close my shorts.

If you choose to play this rally, be very careful and stick with commodity stocks. If the market breaks below SPY 138, exit long positions.

Daily Bulletin Continues...