Major Techinacal Damage – Option Traders – Sell Rallies!

For days we've had the "calm before the storm" as traders waited for the Fed's decision. Yesterday, a decent durable goods number and an unexpected build in oil inventories help to spark a short covering rally. The "dogs were barking" and stocks that have been hit hard were leading the rally. I mentioned yesterday that the Fed was likely to keep rates unchanged and that it would lead to a short term rally. I also advised you to favor the short side. That advice is paying off today.

The Fed pointed to higher rates in the future. At this juncture, a .25% rate hike has been factored into September bond prices. I believe the Fed wants to see the impact of current mortgage resets before it raises interest rates. 30-year mortgage rates have gone up 33 basis points in the last two weeks and a rate hike right now would force even more homeowners into foreclosure as they try to negotiate fixed-rate mortgages. The Fed just got done throwing the kitchen sink at the financial crisis and they are reluctant to change course.

Inflation is everywhere and it is just a matter of time until it creeps into the core. On a producer level, the PPI has been "hot" for many months. Traders took comfort when the CPI did not move up correspondingly. High food and oil prices have a ripple affect and manufactures are raising prices even if it means selling less product. Both FedEx and UPS said that fuel surcharges are responsible for higher shipping prices and demand is softening. Consequently, they both lowered earnings forecasts for the rest of the year. Dow Chemical announced that they are raising prices by 25% and they are cutting production. Customers are cutting back on their consumption as prices increase. Continental Airlines grounded 62 jets and it is laying off 3000 employees. United Airlines grounded 100 jets and it is laying off 1000 pilots (1400 more could be laid off). Imagine what this will do to ticket prices and think of the impact on the tourism industry. This week, China negotiated iron ore prices with Rio Tinto. They have doubled in price since the last negotiation. Iron and metallurgical coal prices have skyrocketed and that is leading to astronomical steel prices. Outside of the oil industry, I can’t imagine anyone else being able to justify new construction. Oil prices dipped temporarily, but they have snapped right back. Global demand outstrips global production and high prices will continue. Uncertainty in Iran/Nigeria and a hurricane-producing La Nina weather pattern will keep oil prices high.

Central banks around the world are raising interest rates and their economies are feeling the pressure. Global markets are rolling over and I do not see the strength there to pull us through this recession. I'm losing faith in the theory that global expansion will provide a soft landing for our economy.

The financial sector is getting pounded. MBIA and Ambac are toast now that Moody's has lowered its rating. These mortgage insurers provided protection to other financial institutions and now that safety net is gone. This morning, Fortis (insurance company) said that they will need to secure additional financing. Last week, Fifth Third Bank said it needs to raise $2 billion. Today, Goldman Sachs said that it believes Citi will take another $9 billion a down and Merrill will take another $4 billion write-down.

After yesterday's close, RIMM and NKE both lowered earnings guidance. Higher costs and lower demand were to blame. Both companies sell "must have" consumer products and this will not bode well for the entire retail sector.

Jobless claims came in higher than expected and the four-week average sits at 378,000. Continuing unemployment claims rose to 3.14 million, a four-year high. If the unemployment rate continues to climb, our high debt levels will quickly push us into a deep recession. Next week, we will get the Unemployment Report. Last month's number was very weak and a repeat could push this market down to the double bottom support level established in March. Due to the holiday, the number will be released on Thursday. Traders will brace themselves for a worst-case scenario and the market is likely to drift lower ahead of the number.

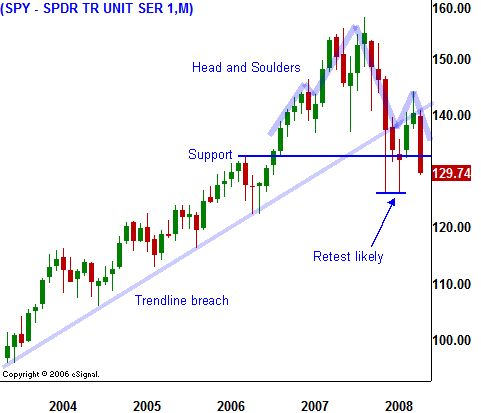

Major technical damage has been done. The market broke below support at SPY 138 and it continued to drop, taking out a horizontal support at SPY 132. That was a key support level for two reasons: SPY 132 was the capitulation low from March 2007/August 2007 and in April, we saw two large up gaps from that level as buyers stepped in with confidence. This time around, we only saw a brief bounce from that level and the "bid" is gone. On a five year chart, a head and shoulders pattern has formed and the neckline has been breached. When major technical patterns form on a five year chart, they need to be respected.

Many of you took advantage of the special offer on the Level 1 Option Report. I bought puts for my FOMC trade and they are kicking in. New subscribers have started off on a solid note. This service has been hot and I have another trade lined up. Subscribe now!

The FOMC put trade in the Level 1 Option Report still has room to run. As a result, I have lowered the subscription price by 25% - TODAY ONLY! This will be the lowest price of the year! Subscribe now for just $127.45/quarter and get in this trade. This fast moving service keeps it simple by buying options.

.

.

Daily Bulletin Continues...