Option Traders – Watch For A Deep Decline And An Intrday Reversal!

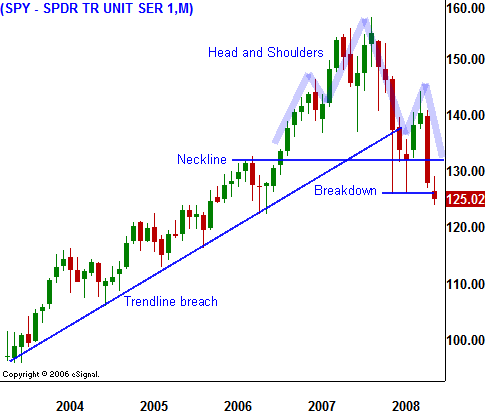

The market is in a bona fide decline that started last October. On a five year chart, a head and shoulders pattern has formed and the neckline has been broken. We now know that the March rally was nothing more than an oversold bounce. As the market reached a critical resistance level at SPY 144, it was slapped down in dramatic fashion. Since the middle of May, many support levels have been broken.

Bulls stepped up to the plate in March once the double bottom had been formed at SPY 126. A few months ago, it looked like the Fed's "kitchen sink" tactic might have prevented a financial disaster. As this credit crisis unwinds, we are seeing signs that there's more to come.

Yesterday, Fannie Mae and Freddie Mac made new lows. If a proposed accounting change is enacted, they will have to collectively raise over $70 billion to meet requirements. The Moody's downgrade in May already put the future of both firms in jeopardy. Financial stocks have taken a beating and no one wants to get in the way of this freight train. Sovereign investment has dried up and for those who have noticed, banks are no longer raising capital from China or the Middle East.

At one point, analysts projected a "soft landing". Our economy would be spared from a recession as multinational companies generated business from global expansion. That theory does not look valid as the BRIC markets (Brazil, Russia, India, and China) decline. We will need to pull ourselves out of this mess.

Unfortunately, a number of factors will keep us from slipping further into a recession and this market decline will continue. Our unemployment rate continues to climb and our nation is burdened with debt on a federal, state, municipal and personal basis. The Fed has fired all of its "silver bullets" and the spigot is wide open. Consequently, the dollar has been pummeled and it now sits at all-time lows. It now costs us more to purchase foreign goods/commodities and inflation is on the rise. Consumers have also fired all of their bullets. High mortgage and consumer debt have drained discretionary spending. High food and energy costs are eating up what little money is left and over 60% of the rebate checks were spent to pay bills.

I am expecting a dismal earnings season. Companies have not been able to pass on higher costs to consumers and profit margins will suffer. There have been many examples of this in the last few weeks and the warnings span across many industries. Nike lowered guidance last week and that will not bode well for the apparel industry. NVIDIA also lowered its guidance and their video cards are used in a multitude of consumer electronics products. Expectations have been lowered for this earnings season, but it's the guidance that could really weigh on the market.

Yesterday, we closed below critical support at SPY 126. That was considered to be a safety net that the bulls could lean on - now it is gone. Major support levels generate buying well before they are tested and in this case, the market easily took out the “double bottom”.

The VIX is starting to rise and I am seeing two-sided market action. The stocks that have been leading this market higher have started to break down. These two events tell me that we are nearing a capitulation low. The market is very oversold and we can expect a decent bounce after we hit another major "air pocket". The key here is that it will get worse before it gets better. I want to see a huge 40+ point drop in the S&P 500 futures with an intraday reversal before I get long.

I am starting to line up some long candidates. Look for stocks that have been able to maintain a long term up trend and are jumping each time the market tries to rally.

The economic news this week is light. We will get earnings from AA after the close today and I am expecting a weak number. Aluminum prices have been slipping, manufacturing costs have been on the rise and this company continually disappoints the market. Before Thursday's open, we will hear from MAR and we will be able to gauge the extent of travel cutbacks. Perhaps the biggest event of the week will come Friday when GE releases its earnings. There is a possibility that the market will establish a capitulation low before then and we will rally on their earnings. They missed badly last quarter and I am not expecting a repeat performance from a company that's known for its consistency.

Most importantly, remember that playing a bounce requires you to take profits quickly. The long-term trend is down and you want to make sure you don't get caught with a bunch of long positions. I doubt that any current bounce will be able to get us back above horizontal resistance at SPY 133. That level represents the capitulation low from March 2007 and August 2007.

Daily Bulletin Continues...