If We Rally Into The Close – Buy Call Options – Trade Small Size!

Yesterday, the market posted its first decent rally in many weeks. Wells Fargo, Northern Trust and Charles Schwab posted good numbers and that helped to rally an oversold financial sector. Oil also retreated and that helped to take the sting out of a very high CPI number. Comments from Ben Bernanke reassured the market that financial stability, not inflation, was the Fed's priority. The market was able to hold its gains and a rally into the bell.

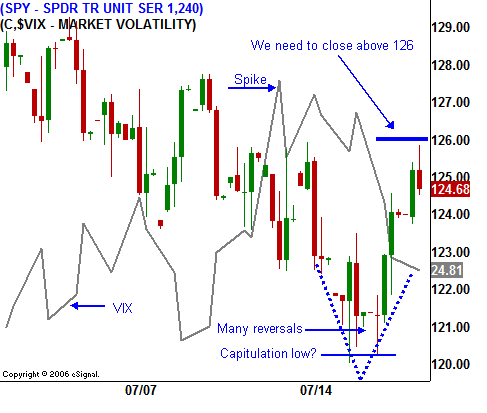

As I mentioned yesterday, serious technical damage has occurred and the market needs to follow through by closing above SPY 126 for me to play the bounce. This morning, a lower than expected jobless claims number, a 9.1% jump in housing starts, lower energy prices and solid earnings from J.P. Morgan pushed the market higher. After two hours of trading, prices have retreated and bears are testing the buying conviction.

This is a big earnings day and before tomorrow's open, we will hear from Advanced Micro Devices, CapitalOne, Gilead, Google, Merrill Lynch, Microsoft, Zions, Citigroup, Honeywell and Schlumberger. Overall, my expectations for these beaten down stocks are positive and I believe this mini rally could have legs. If the numbers spark buying, we could have a gap up on the open due to option expiration short covering.

There are not any economic releases tomorrow.

I've pointed out in today's chart that we may have seen a minor capitulation low. I say minor because I did not see the huge washout that accompanies a bona fide level of panic. However, after the IndyMac banking failure and concerns over Freddie Mac/Fannie Mae, we did see a spike in the VIX. If you recall the capitulation low from Bear Stearns, we did see a rally on the bailout news.

The downside has been tested today and the bears were not able to push this market down. There are too many positive factors in play and the A/D is a positive 2:1. I believe the market will close higher today and I also believe there is a chance for follow through tomorrow.

Next week, the economic numbers shape up like this: LEI, Beige Book, Durable Goods, Michigan Sentiment and New Home Sales. I am expecting a negative bias from these numbers and that is already factored into the market. Weak economic conditions are priced in and earnings/guidance (not economic releases) will drive the market.

The major earnings releases next week include Bank of America, Merck, Apple, QLogic, SanDisk, Steel Dynamics,, AK Steel, Caterpillar, DuPont, UPS, UnitedHealth, Broadcom, Norfork Southern, Yahoo, AT&T, Boeing, General Dynamics, McDonald's, Peabody Energy, Whirlpool, Allstate, Amazon, QUALCOMM, 3M, Wynn Resorts, Black & Decker and Arch Coal. By the end of the week, we will know how the overall earnings season is shaping up. Most importantly, we will be able to gauge guidance for the third quarter.

There are too many negative influences in the market for a sustained rally. At this juncture, earnings season could provide a short-term bounce to a deeply oversold condition. I will play biotechs and international industrials during this bounce. Once the rally runs its course, the negative influences (inflation, energy, unemployment, credit risk) will continue to weigh on the market and the next leg down will begin.

I am short-term bullish and I will play this little move very cautiously knowing that I am on the wrong side of the intermediate-term down trend. My bullish positions will be sized much smaller than my bearish positions and I will take profits along the way. I will be looking for signs that the market rally is stalling and then I will gradually start scaling into bearish positions. I already have a list of weak stocks that are in a long-term downtrend and have bounced off of their lows. I will revisit many of these shorts soon.

Daily Bulletin Continues...