Very Lame Price Action – The Market Can’t Even Sustain A 3-Day Rally!

Yesterday, the market was able to overcome early weakness that resulted from worse than expected Freddie Mac earnings. By the end of the day, prices had moved to the plus side and we were seeing follow through to Tuesday's FOMC rally.

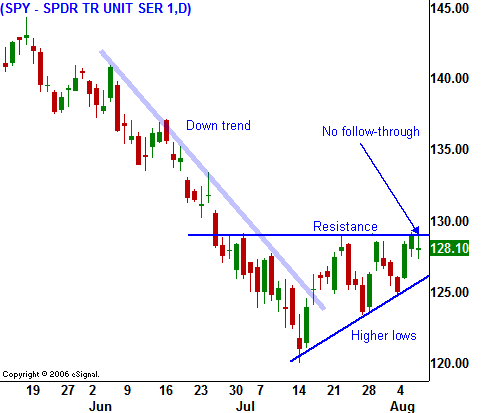

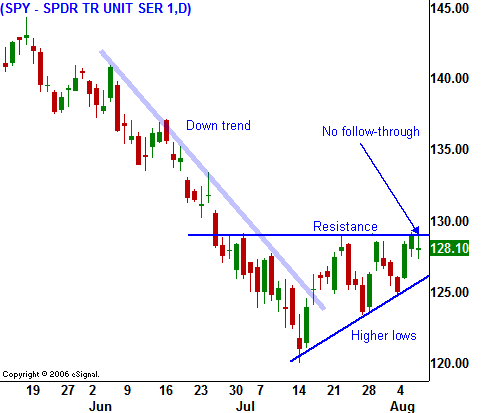

The market has rallied above the double bottom support level formed in March and bulls are leaning on the SPY 126 level. Oil has fallen by almost $30 per barrel from its peak and the market should have been able to generate a short covering rally from a deeply oversold condition. Unfortunately, that bounce has not materialized.

This morning, I expected softer rhetoric from the ECB and I was surprised by their hawkish statements. Economic statistics show that European activity is slowing down and I am a bit perplexed by their stance. Tighter monetary policy will accelerate their economic decline. International companies that do business in Europe have observed weakening conditions and they have lowered their expectations abroad.

After yesterday's close, AIG took an enormous write-down. That news provided a negative backdrop for the opening and financial stocks are taking another beating. Higher unemployment will cause the credit crisis to spread and this morning the initial jobless claims increased. Before the open tomorrow, FNM and MBI release results – expect more bad news.

All things considered, this is a very weak market. While my long-term bias is bearish, I thought that we might see a nice short covering bounce over the remainder of this week. The market can't get off the deck and that signals trouble ahead. We are consolidating above a key horizontal support level and I believe that the market is simply gathering ammunition for its next leg down.

Next week, the economic indicators are relatively insignificant. The CPI will be released in the middle of the week. As long as oil does not rally, "hot" inflation numbers will be tolerated. Tuesday, the market stomached a very high PCE deflator because oil prices are falling. This is the inflation measure used by the Fed and it normally would have weighed on the market. Consequently, I don't believe the CPI will carry much punch. If it does have an impact, the reaction will be negative. Initial jobless claims could also weigh on the market if they continue to climb. The Empire Index, Industrial Production and Consumer Sentiment round out the economic numbers.

On the earnings front, retail will dominate the scene. JCPenney, Wal-Mart, Kohls and many others will post results. The rebate checks have been cashed and I am expecting weak guidance. The sector has bounced in reaction to lower gasoline prices and it has set up for a decline.

Option expiration probably won't have much of an impact since the market has been directionless the last few weeks. Trading next week is likely to be quiet. The bulls can't get anything going and the bears are not as aggressive as they were a few weeks ago. Many traders will take advantage of the doldrums and they will take their vacation before their kids head back to school. If there is a move, I expect it to be lower. A hot CPI number, higher initial jobless claims, lower retail guidance and a lack of sponsorship by the bulls this week influenced my forecast.

Daily Bulletin Continues...