Fed Comments Fuel A Rally – No Real News – Stable Rates Priced In!

Yesterday, the market was able to fight off early weakness and it closed higher. A drop in initial jobless claims helped the recovery. Today, there are a number of news events that are driving the market higher.

The most significant is a statement from Fed Chairman Ben Bernanke that moderating inflation will allow the Fed to keep interest rates low. This news was important given the rise in core prices we saw in this week's "hot" PPI number. However, the Fed has previously stated that the economy and the financial crisis are the focus. I don't see this news as significant since the market has priced in stable rates.

Financial stocks have been in the spotlight all week and today there is speculation that Lehman is close to a deal. The Korean Development Bank has expressed interest. Deals like this tend to be finalized over the weekend. It is also likely that the U.S. Treasury will bail out Fannie Mae and Freddie Mac. It’s seem s like a matter of when, not if. That will not bode well for shareholders, but it will make the debt holders whole. This event could temporarily ease anxiety in the financial sector.

Oil prices are down and that is also supporting this rally.

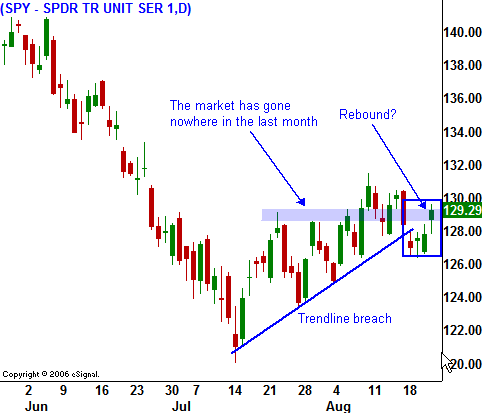

The market is trying to latch on to any shred of news. It lacks direction and in today's chart you can see that we are right where we were a month ago. There has been plenty of choppy trading, but we have not moved.

For weeks now I have been advising you to keep your powder dry. This is a low probability trading environment. I like to trade is much as anyone, but experience has taught me to be patient during these times.

The good news is that prolonged trading ranges produce sustained breakouts. I believe we are only a few weeks away from better trading conditions.

As long as we are between SPY 126 - 130, don't trade any size. If you choose to trade, I suggest day trading stocks. They are very liquid and you can be in and out the same day. Once the early momentum is established, the market has a tendency to follow through in that direction.

Today’s action feels heavy. It’s a nice rally, but we have not been able to add to the gains. There is a chance that prices will slip this afternoon.

Daily Bulletin Continues...