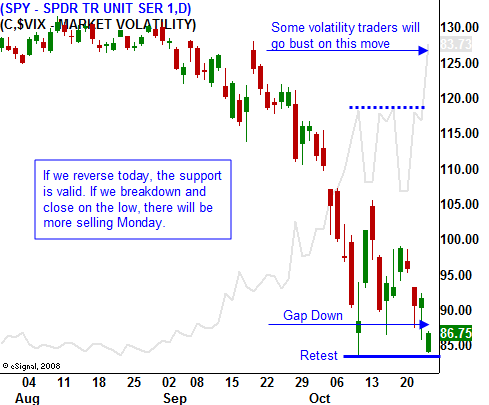

Look For More Selling Into The Bell – We Have Not Seen The Low!

Yesterday, it seemed as though we might have seen a capitulation low. Stock prices drifted lower throughout the day and the market was able to stage a reversal.

Overnight, foreign markets plunged 10% and some stock exchanges halted trading. The S&P 500 futures were down limit before the opening bell today. Prices have stabilized, but we are not out of the woods yet.

Today's retest of SPY 85 was too easy. Ideally, a firm support level would have attracted buyers before that low was tested. Action similar to yesterday's reversal with follow-through buying today would have confirmed that temporary low at SPY 85. There are too many negatives influencing today's market and I believe we will see an afternoon decline.

You hear a lot about credit default swaps (CDS). Think of them as insurance policies that were created by financial institutions. They are over-the-counter products and they are not cleared on an exchange (that is part of the problem). No one controlled the credit worthiness of the originator and they did not regulate how many CDS were written. Exchanges guarantee that the other side will make good on the trade and they require margin (good faith money) to be posted. Exchanges also enforce position limits. Hedge funds bought stocks (US and foreign) and they bought credit default swaps (US and foreign) as a hedge. Since the position was relatively low risk, they leveraged it many times over. When Lehman failed, the insurance held by hedge funds was gone and the entire CDS market went into a tailspin. It's doubtful that financial institutions can make good on the insurance they sold. These derivatives were sold and re-written and financial institutions can’t assess their own risk. If they don’t know their own situation, they certainly won’t trust counter-parties.

As a hedge fund, you are naked and you have to adjust risk. You have one of two choices. You can sell your long positions, or you can buy puts on the S&P 500. As hedge funds sold their holdings, stock prices declined sharply. As they bought puts, implied volatility spiked to historical highs. The declines accelerated and brokerage firms raised hedge fund margin requirements. Now they were in a position where they had to liquidate. This means they sold commodities and stocks to generate cash. The baby has been thrown out with the bathwater and this unwinding continues. Investors are pulling their money out and that is adding to the liquidation cycle.

Many other hedge funds had a curveball thrown at them when the SEC imposed the short restriction on financial stocks. Hedged long/short portfolios had to cover short positions in the financial sector and once again they had to sell their longs because they were unhedged.

This has created a vicious selling cycle. Leverage is killing this market and until it has been reduced to nominal levels, the selling will continue.

We also have another cycle to worry about. Americans are debt laden. The average baby boomer has less than $100,000 saved for retirement. Many thought that their home would finance their retirement. Unfortunately, one out of every six US homeowners has negative equity. This percentage continues to grow and it has doubled in the last year. Investment portfolios are worth half as much as they were a year ago. As conditions continue to worsen, many people are shifting their focus from retirement to survival. The unemployment rate continues to climb and as consumers cut back on spending, companies reduce inventories and staff.

Rising unemployment hits the government from both sides. Income tax revenues decrease and transfer payments (unemployment, welfare) increase. Five states have barely enough money to cover unemployment compensation for the next two months. Two of those states (New York, Florida) have huge populations and enormous needs. The government will have to open its wallet once again. Initial jobless claims rose yesterday and continuing claims are almost up to 4 million. Next week's unemployment number will be painful.

The events I've just described will take years to resolve and we are in a secular bear market. This market decline is the event of a lifetime and it will be talked about for generations. The good news is that we might see a capitulation low in the near future.

Bear markets have very sharp rallies and I believe we are close to seeing one.

• LIBOR rates have decreased for the 10th straight day and banks are lending to each other.

• The market has retraced 50% from its all-time high year ago and that is technically significant.

• Option implied volatilities have spiked to historical highs and the risk/reward of premium selling is getting very attractive.

• Forced hedge fund liquidation has passed its climax and selling should abate.

• Earnings (ex-financials) are up 10% this quarter Y2Y and solid stocks have been sold indiscriminately.

• We are entering the most bullish week of the year starting Monday and historically it has performed better when it follows a large decline.

Here's how I see the next few days unfolding. Today, we are likely to see a rebound from the lows. I wouldn't trust that move and I believe that we will see selling into the close. No one wants to be a hero and go home long ahead of the weekend. When the market opens next week, we will see additional selling Monday and possibly Tuesday. That's when I believe the capitulation low will be established. It's important to wait for an intraday reversal and a higher close. If the market is able to convincingly add to those games the next day, a meaningful support level will have been established.

The best trading strategy for these market conditions is to sell naked OTM puts on stocks that you like. If you aren't familiar with the strategy, it's the same as covered call writing on an unleveraged basis. The option premiums are rich and you will be well rewarded for the risks you take. Focus on stocks that have strong balance sheets and will not be dependent on strong economic conditions. Also look for stocks that have formed a base and have been resilient during this market decline. Those are your naked put candidates.

.

.

Daily Bulletin Continues...