This Rally Should Have Legs – Sell Out-of-the-Money Puts and Buy Out-of-the-Money Calls!

Yesterday, the market finally staged the type of rally we've been looking for. Prices opened higher early in the day and after a brief attempt at a selloff, the market screamed higher the rest of the day. In prior weeks, a higher gap opening would have attracted sellers and they would have been able to push the market down. The fact that the market was able to rally into the close and hold those gains today is encouraging.

All eyes are on the FOMC meeting today and a half-point rate cut is expected. Interest rates around the world are falling as central banks respond to the financial crisis. Yesterday, China cut its rates by a quarter of a point. That is the third time they've done so in the last six weeks. Japan's interest rates are extremely low and they are considering a rate cut. Norway's central bank cut by 50 basis points to 4.75% today and many analysts believe that the ECB and Bank of England will cut interest rates by a half a point next week. Germany announced that its inflation rate has slowed and that further supports this notion.

This morning, durable goods orders came in better-than-expected. Before we get too excited, let's remember that the market is poised to bounce from an oversold condition. Most of the other economic releases have been dismal and consumer sentiment is at all-time lows.

The credit crisis is abating and all of the Fed's initiatives are starting to bear fruit. If we can work past the liquidity crisis, we have a chance for an orderly decline over and extended period of time. Earnings will once again be a focal point. To date, S&P 500 companies have increased net income by 10% (excluding financials) this quarter compared to last year. Unfortunately, most have guided lower and we have yet to see the repercussions of a frozen financial system. That impact won't be felt until next quarter.

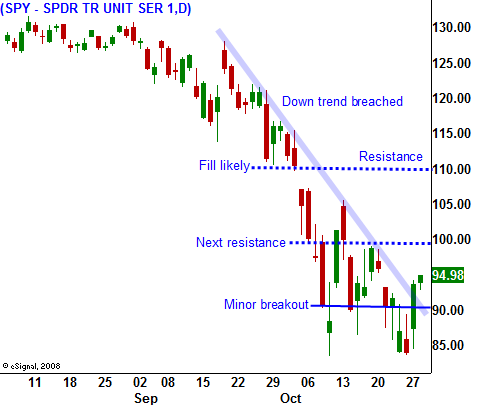

From a news perspective, the bulls should have clear sailing through next Wednesday. If they can sustain back-to-back rallies, we will have a nice rebound. Short covering will help to fuel the rally and if the SPY gets above 100, it could run to 110. At some point, we will fill in the gap that I've noted in today's chart.

As we get closer to next Friday's Unemployment Report, I will take profits on my long positions. Weak employment will remind traders that macro conditions are deteriorating.

For now, I would still focus on selling out of the money puts on stocks you like. The premiums are rich and if the market simply holds support, the implied volatility will collapse.

I expect a half-point rate cut today and selling after the news. Lower interest rates won't stimulate the economy, but they will facilitate banking. Bears are likely to try and shake out bargain hunters. That weakness will evaporate by the close and the market will march higher. I can feel that a bid has returned and yesterday's rally actually has some teeth.

If you want to get long, I suggest day trading the stock. The liquidity is much better and your price movement will be better since you aren't fighting rich option premiums. If you must trade options, I suggest creating a synthetic stock position where you sell puts to finance your calls. This position has the same risk as being long the stock so you have to watch your downside. The concept is to sell rich put option premium to offset rich call premium. Since I don't like overnight risk exposure, I suggest selling out of the money puts to finance the purchase of out of the money calls. This strategy will work well if you are expecting volatility ahead of an explosive move higher.

I have to conclude every post with this note. We are trading a bear market rally and we are on the wrong side of a long-term downtrend. Keep your positions relatively small and take profits along the way. Once this rally exhausts itself, you can get more aggressive with bearish trades.

Daily Bulletin Continues...