Bear Market Rally – Sell Out of the Money Puts – Don’t Overstay Your Welcome!

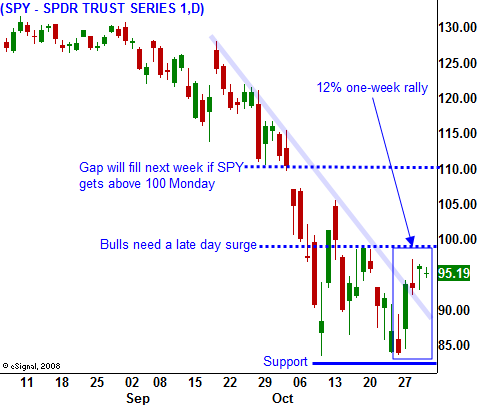

Market conditions are gradually improving and I still expect to see a bear market rally. However, a breakout above SPY 100 needs to happen quickly. If bulls can't muster enough strength to do that, short-sellers will regain confidence and they will try to knock the market back down. If we do get a quick breakout, short covering could fuel us to SPY 110.

As I mentioned yesterday, bears would test the downside and when they failed to generate momentum, buyers would step in. We saw a big rally right into the closing bell. With every failed decline, buyers will get a little more aggressive.

Central banks around the world have flooded the market with liquidity. Global interest rates are on the decline and we are likely to get more good news on that front next week. The Bank of England and the ECB are both expected to lower rates by .5%. This is a major accomplishment given Trichet's (ECB President) reluctance to lower rates. Today, the Bank of Japan lowered rates by .2%, the first time in seven years. Their interest rates were already at a miniscule .5% and now they are at .3%.

Next week, the ISM reports are the only significant economic releases before Friday. Weak numbers are factored in and I don't expect them to spoil this market bounce. However, by next Thursday, I suggest taking profits on long positions ahead of the Unemployment Report. I would not go short unless we get a huge rally well above SPY 110.

We have reversed early losses today and the market is in positive territory. I am expecting a rally and I still favor selling out of the money puts on strong stocks. If you want to get more aggressive, buy stocks (not options) and take profits before the close. I would love to see a pattern of lower opens and higher closes over the next few days.

Daily Bulletin Continues...