Buy the Rumor – Sell the News. Don’t Be Fooled by This Rally!

The market is grinding its way back from early losses on the hope that strong words from the president will have an effect on Senate Republicans. The stimulus plan has stalled as politicians compromise the way the money will be spent.

Personally, I'm against any stimulus plan. The money will get wasted on "pork" and all we need to do is to stabilize the financial system. When banks rid themselves of all the junk, they will be in a position to resume lending. Some banks will fail and others will prosper due to lower competition. Once this passes, the economic wheels will get lubed and economic activity will start to pick up again.

If the government wants to help, it should focus on tax credits for business investment. As companies take advantage, people will be hired. Relatively high wages, union negotiations, OSHA, EPA, Sarbanes-Oxley and the second highest tax rate in the world are investment deterrents. We need to give corporations a reason to reinvest in the United States.

The government will have to finance $3 trillion to pay for the bailouts and stimulus plans (that is a conservative estimate). Once the states start holding their hands out, this number will jump. As more debt comes to market, interest rates will rise because new investors will demand a higher rate of return. Today, Bill Gross (the largest bond manager in the world) said that the Fed is likely to buy US treasuries once the demand starts to wane. The intent is to keep interest rates low. This action mimics a printing press and it is very inflationary. In the process, the dollar will get crushed.

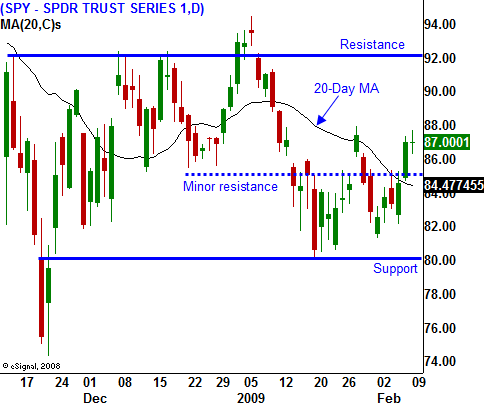

I don't see any earnings or economic news that will drive the market this afternoon or tomorrow morning. Consequently, we are in “buy the rumor” mode. Once the stimulus package is approved, the market will be looking for its next fix and it will decline. In the chart, you can see that we have inched our way above minor resistance at SPY 85. The market is chopping back and forth between SPY 80-92 and that pattern is likely to continue.

Commodity stocks look attractive at this level. If the Fed starts to buy treasuries in the next month or two, these stocks will rally as the dollar falls. I like selling out of the money puts in this sector. However, I would not get too aggressive today since I believe we will see a decline after the stimulus package passes.

If this process takes a few more days, the market will likely grind higher since it is latching on to potential good news. Last Friday's Unemployment Report was about as ugly as I've ever seen and it will eventually weigh on the market. I am more inclined to short weak stocks at this juncture. Struggling companies that have rebounded on a short covering rally will make nice out of the money call credit spread candidates. The closer we get to SPY 92, the more attractive these trades are.

For today, the market seems comfortable moving higher and the advance /decline is a positive 4:3. Do not get long!

Daily Bulletin Continues...