Look For Signs Of Support – The Mark-To-Market Vote Could Provide A Spark This Week!

Last week was one of the roughest weeks we've seen during this market meltdown. Each day the market had to overcome a new obstacle.

Heading into the week, an abysmal GDP number, shrinking durable goods orders and increasing initial jobless claims weighed on prices. Throughout the week the Beige Book, ISM manufacturing and the ADP employment index compounded the concerns.

President Obama outlined his plans and the market did not embrace them. Increased spending on social programs won't create jobs or stimulate the economy. Businesses need incentives to invest and they are being slapped with higher taxes. Corporations with overseas operations will be hit even harder because they "have shipped jobs overseas". Politicians are contemplating a policy where foreign workers are the first to be laid off. Small businesses will be required to set up 401(k) plans for all employees. This will increase their payroll expenses since they have to administrate it.

Eastern European countries are on the ropes and a bank failure seems eminent. The EU will not be able to generate enough support to aid these banks. Each of the countries is struggling to finance its own crisis. Last week, Hungary (an EU newcomer) asked for help and Germany (the largest number) squashed that notion. A bank failure could have a devastating effect on European banks and that ripple effect would be felt around the world. From my perspective, this remains the biggest concern for the market.

Last Friday, the Unemployment Report was released. The unemployment rate jumped to 8.1% and the rate of acceleration is greater than I've ever seen. After spending most of the day "in the red" the market was able to mount a rally. Worst case scenarios were priced in before the release and shorts decided to take profits when they could not conflict further damage on the market.

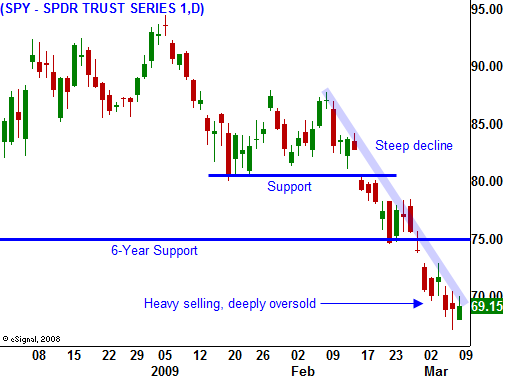

The S&P 500 stands at 12-year lows and today the Nikkei made a new 26-year low. For those who think that our market cannot go down over a sustained period of time, they are wrong. Japan's problems started with high debt levels and a real estate bubble, sound familiar? This is the second largest economy in the world and we should be prepared for a prolonged economic decline.

The economic news this week is fairly light. Initial jobless claims and retail sales will weigh on the market later in the week, but bad news is expected. The greater catalyst this week could come from a decision on mark-to-market policies. If banks are no longer required to price ill liquid assets at pennies on the dollar, they will have an instant pop to their balance sheets. This policy change would not cost the government a dime and it could really fuel financial stocks. With more reserves to work with, banks will be more willing to lend. I expect this change to get passed. The Fed and the Treasury have already done everything else in their power and this seems like a no-brainer.

Traditionally, the middle of March has been relatively strong. The market is in a deeply oversold state and any shred of good news could spark a substantial short covering rally. Prices are compressing and this morning we have seen a nice rebound from an early decline.

In the absence of other major news, I expect the market to be able to rebound this week. In fact, I believe we will see a small rally into the bell. I am easing into new naked put positions today and if support holds I will have 75% of my position on by the end of the week. I am focusing on commodity stocks and a handful of cyclical stocks that have formed strong support over the last few weeks.

Daily Bulletin Continues...