Watch For A Big Day With Strong Momentum During Triple Witching!

Yesterday, the market tried to continue the rally from last week. Overseas markets were trading higher and additional good news from the financial sector provided a positive backdrop. As the day wore on, the market got tired and it gave back most of its gains for the day.

Bulls are not overly concerned that they will miss the next big rally and they prefer to buy pullbacks. Many issues still remain and the actions by the Fed and Treasury have yet to play out. A nice, controlled rally would be ideal. If prices get ahead of themselves, the bears will quickly step in and reestablish downward momentum.

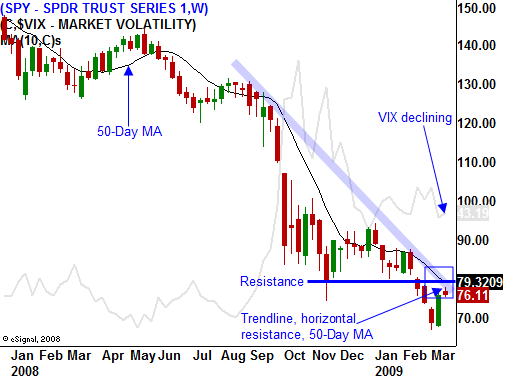

In today's chart I have outlined a number of converging resistance levels that will keep a lid on the market. The downtrend on the weekly chart, horizontal resistance at SPY 81 and the 50-day moving average collectively provide a major obstacle. If the market can consolidate at this level, it might be able to break through. We will need a material news story to spark a short covering rally. That move will generate quadruple witching buy programs and we could challenge resistance.

Mark-to-market rule changes by FASB would pack the most punch this week. Unfortunately, I'm not sure that they are prepared to act so quickly. The Treasury has not instilled confidence and I doubt that they will come up with a solution to the toxic asset problem this week. They are discussing the "bad bank" concept. The FOMC meets tomorrow and I can't imagine hearing anything new from them. The Fed Chairman was on 60 Minutes this weekend and they have been very vocal.

In order to build on this rally, I feel that we need to start moving higher today or tomorrow. This momentum needs to build on itself or bulls will lose confidence. They will view this move as a temporary short covering rally and they will put their wallets back in their pockets.

CPI, the FOMC, initial claims, LEI and Philly Fed are all likely to produce a muted reaction this week. This morning, the PPI rose .1% when an increase of .4% was expected. It did not have an effect on the market. Housing starts came in better than expected, but that number was viewed with skepticism. If initial claims came in low (I don't expect this) the market might rally. However, analysts will be looking for a sequential drop and they want to make sure that it was not an aberration. The unemployment rate continues to jump and it is the biggest current concern.

During quadruple witching, it is customary to see one wild day during the week of expiration. Currently, I would have to say that it favors the upside. Watch for a day where strong momentum results from a major news item. Follow that move since it is likely to last throughout the day and perhaps the week.

I have been selling out of the money puts and I currently have a full position. The majority of my trades are way out of the money and they will expire this Friday. I have started writing April puts so that I can distance myself from the action and collect decent premiums.

Today, advancers lead decliners by 3:2. In the absence of news, the bulls have the momentum and the ball. I expect to see prices grind higher throughout the day.

Always be mindful that we are "going against the grain". The long-term trend is down and we are simply trying to take advantage of a bear market rally. This means that your bullish trades should be smaller than your future bearish trades (when your bias turns negative).

Daily Bulletin Continues...