Employment Beats Estimates – Higher Interest Rates Are Keeping A Lid On the Market.

This morning, the long-awaited Unemployment Report was released. It came in much better than expected. Analysts had projected 520,000 job losses in May and only 345,000 jobs were cut. The unemployment rate spiked to a 25-year high of 9.4%. Given the breakout earlier this week, I thought the market would be off to the races.

After an early gap higher, the market reversed and it went into negative territory. Bond yields jumped on the news and traders are wondering if the Fed will stop its quantitative easing. As economic conditions improve, interest rates will rise.

Next week, there will be two very large bond auctions and their outcome will influence the market. If the bids are "light", bond prices will drop and yields will move higher. Higher interest rates will increase the government's cost of capital; it will increase mortgage rates and credit card rates. That will slow down an economic recovery.

The news today was encouraging. Employment is the key to an economic recovery. Higher interest rates will keep us from overspending. Americans will be rewarded for saving and from my perspective, living within our means for a long period of time is the solution to our debt problem. This path means that growth will be gradual, but sustainable.

The market has run up 35% from its low three months ago and it needs to take a breather. The jobs number was better than expected; however, 350,000 jobs were lost. Under any other circumstances, this would be viewed as a weak number. Bill Gross, one of the largest bond fund managers in the world, projects economic growth in the range of 1 to 2% for the next several years.

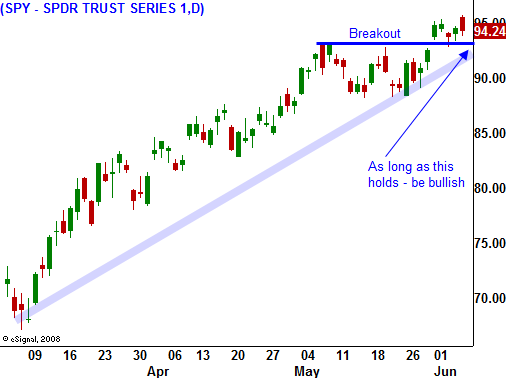

The economic news is fairly light next week. Retail sales and initial jobless claims are the highlights. Given today's better-than-expected unemployment number, the market should be able to hold the breakout this week. Next week's bond auction should result in higher interest rates and that should keep the market from jumping higher. The momentum favors the upside.

I am very cautiously selling out of the money put spreads on commodity stocks. The market is volatile and today's reversal tells me that there is overhead resistance. As long as the SPY stays over 93, I will maintain a slightly bullish bias. If it falls below 93, I will quickly shift to a bearish bias.

Daily Bulletin Continues...