A Great Bond Auction Saved the Day! Don’t Be Fooled By The Good Jobless Claims Number.

Last week, the market dropped below major support when the Unemployment Report was much worse than expected. Job losses were 100,000 more than analysts had expected and bulls finally threw in the towel. Since March, they have denounced the Unemployment Report claiming that it is a lagging piece of information.

Month-after-month, the news continued to disappoint and the unemployment rate has jumped in a parabolic manner. Weekly jobless claims have not subsided and traders have hawked the number each week in hopes of improvement. This morning, initial jobless claims dropped by 52,000 and it came in at 565,000. That is well below expectations of 605,000. Before we get too excited about this number, keep in mind that it spanned a holiday. Often, people will postpone filing for unemployment until after they return from vacation. Continuing claims increased by 159,000 to its highest level ever (6.88 million).

This morning, retailers posted weaker than expected monthly sales. Wet weather and rising gasoline prices contributed to the decline. People are concerned about their employment situation and they have cut back spending.

Next week, earnings season will begin. We will get a big dose of earnings from financial institutions during the next two weeks. The spread between the borrowing and lending rate has never been higher and banks are hanging on to toxic assets. Profits should be good since they aren’t taking write downs. However, I'm not expecting a big rally from this sector. Banks have issued a lot of stock and it will take many quarters of stellar performance to work off that supply. Toxic assets, commercial real estate loans and high credit card default rates will keep a lid on any financial sector rally.

The market will have to find strength from other sectors. Although 70% of all companies beat Q1 expectations, the market has rallied 40% off of its low and good results are priced in. We will see if companies can "beat" by a big enough margin to spark a rally.

Traders are carefully watching interest rates. This week, the Treasury issued $75 billion in longer-term bonds and the auctions were very well received. That has kept the market treading water.

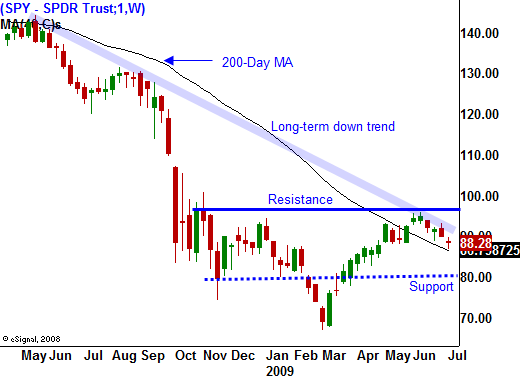

A head and shoulders pattern has formed and early this week the neckline was broken when we traded below SPY 89. That price level also represents the 200-day moving average. As that support level gave way, the selling pressure increased and it looked like we could have a major decline this week. After the 10-year bond auction results were released Wednesday afternoon, the market rebounded. That rally has continued today. The Treasury has to finance its $2 trillion budget deficit and it will keep issuing new bonds every other week. That means bulls will continuously be dodging the interest rate bullet.

The tone for next week will be set Tuesday when Goldman Sachs, Johnson & Johnson and Intel release results. By comparison, economic releases are very light and the market will take its direction from corporate earnings. Interest rates have stabilized and earnings will determine the market's direction. If the market declines, option expiration could have a negative influence since we are trading near a one-month low.

We are teetering on a breakdown and great results are all that can keep us from falling. I believe the market will drift lower during the rest of the summer, but I am not looking for a meltdown. Leverage has been removed from the market and we will not see anything close to the panic selling we witnessed last fall. The market should be able to find support around SPY 80-83.

This is the perfect time to trade relative strength and weakness. The market may not go anywhere, but individual stocks will be making considerable moves.

Daily Bulletin Continues...