Goldman Beats But The Stock Is Flat – Good Results Are Priced In.

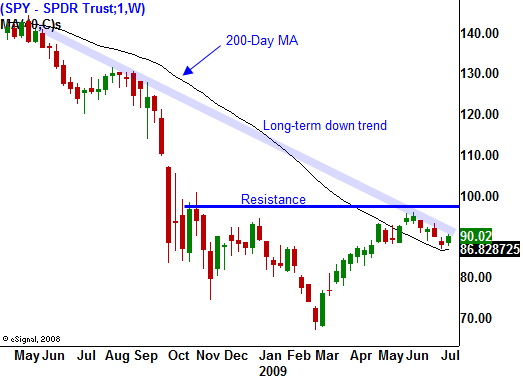

Yesterday, the market staged a huge rally on the back of positive comments made from Meredith Whitney. She has credibility on the street since she accurately forecasted the financial crisis. Financial stocks led the rally and the SPY was able to finish above 89. That is a critical level since it represents the neckline of the head and shoulders pattern and the 200-day moving average.

Great expectations were built into Goldman's stock price and they delivered. They had a 33% rise in quarterly earnings and EPS came in at $4.93 (analysts were expecting $3.49 a share). This is the best run financial institution in the world and they have a history of beating expectations. After the news, the stock is down slightly. That tells me that there might not be a lot of room for financial stocks to run higher. On a "beat" of this magnitude, I expected an opening rally.

The other earnings news was not very good. CSX (railroad) beat estimates, but shipping volumes were very low and the company did not see signs of improvement. Semi conductor equipment manufacture Novellus missed their number and they posted a loss of $.52 per share. Johnson & Johnson beat their number, but profits fell 3.5% and revenues were down 7%. All told, the first day of significant earnings releases did little to impress and these results will not generate a sustained rally. By the same token, they aren't bad enough to topple the market.

News on the economic front was not very encouraging. Producer prices jumped twice as high as expected and they rose 1.8% in June. Rising inflation and a slumping economy are a lethal combination for the market. Retail sales came in much better than expected and they rose by .6%. Auto sales made a huge difference and if you strip out that component, retail sales were only up .3%. Higher gasoline prices also contributed and if you strip out gasoline, retail sales were down .2%. Clearly, the economic numbers were weak. Tomorrow we will get Empire Manufacturing, CPI, industrial production and the FOMC minutes.

After the close we'll hear from Intel and it will set the stage for tech stocks. Given the numbers from Novellus, I'm not expecting great results. YUM Brands will also announce earnings and they are likely to be good. People are still eating out and profit margins should be helped by lower commodity costs.

Tomorrow morning, Abbott Labs and Charles Schwab release earnings. These are two steady companies and the results should meet or beat. They won't have much of a market impact.

The market is struggling to hang on to yesterday's gains and it feels very heavy. It continues to chop back-and-forth and it doesn't pay to take large positions in this type of environment. We need sustained directional movement. Yesterday's rally felt like short covering and we are likely to give back some of those gains today. Decliners outnumber advancers by 3 to 2. There is a large open interest in out of the money index puts and that will only come into play if we drop down to SPY 88. If that happens, option expiration could have a negative influence.

My best advice is to keep your powder dry. Wait for earnings releases and sell put spreads on strong stocks that are near support and want to move higher after the number. By the same token, sell call spreads on stocks that have run up, posted marginal or weak results and want to roll over after the release. We are likely to see a fairly tight trading range the rest of the summer. Interest rates seem stable and decent earnings are priced in.

Daily Bulletin Continues...