Economic Releases Miss Estimates and Spark Light Profit Taking!

Yesterday, the market traded in a very tight range after a nice rebound on Monday. M&A activity and third-quarter "window dressing" got the week started on a positive note. As I've been saying, traders are searching for any piece of information that might drive the market. Today, there were a number of economic releases that are influencing trading.

The ADP employment index showed a larger than expected drop (254,000) in jobs during September. Economists had expected a decline of 210,000. August’s employment number improved by 20,000 and that helped to soften the blow. Traders are seeing improvement and they aren't too concerned about the miss. This was the smallest decline in jobs since July 2008. Tomorrow's initial jobless claims number and Fridays Unemployment Report are likely to show gradual improvement as well.

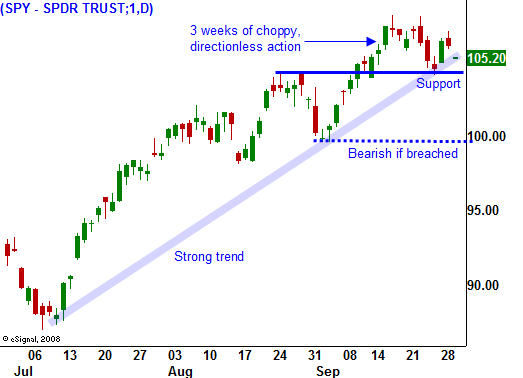

The Chicago PMI fell to 46.1 in September from 50 in August. Economists were expecting 52 and that would have represented economic expansion. This was a considerable decline and it casts a dark cloud over manufacturing. New orders and production both dropped considerably. This release created selling pressure this morning and the SPY tested support at 105.

The final revision to Q2 GDP was released this morning and final estimates showed that output fell at a .7% annual rate. That is better than the original decline of 1% that was reported. It is monumentally better than the 6.4% drop we saw in the January to March period. Many analysts believe that this will mark the last quarter of decline in output for the US economy.

Mortgage applications fell by a seasonally adjusted 2.8%. Last week, new home sales and existing home sales came in lighter than expected and the bottom to this housing cycle has not been established. That is somewhat surprising given falling interest rates, declining home prices and tax credits for first-time homebuyers. From 2001 through 2005, 50% of our employment growth came from the housing sector (this includes building, lending, realtors...). This is a critical component to an economic recovery.

Economic releases are "less bad" and even though they have missed estimates, they have not generated selling pressure. We will see nervousness ahead of the Unemployment Report, but end-of-month fund buying should keep the selling pressure contained this week.

The real fireworks will start during earnings season in two weeks and normal activity levels will return. It is quite possible that we will test support between now and then, but I expect SPY 100 to hold. Earnings and revenues should post nice year-over-year gains and that will fuel the final leg of this rally. Bulls already have low interest rates as a tailwind and the Fed will stay accommodative. Asset Managers are under allocated and they are aggressively buying stocks for fear that they will miss a year-end rally.

I have been selling out-of-the-money puts on strong stocks, but I am waiting for a more substantial pullback before I add. I have about one third of my desired risk exposure on at this time and if we see a nice pullback by the end of the week, I will add to my positions.

The market has been able to recover from this morning's lows. I would not be surprised to see afternoon profit-taking with a close near SPY 105. Be patient.

Daily Bulletin Continues...