The Next Leg Of This Rally Will Be hard Fought. I Expect To See Profit Taking This Week!

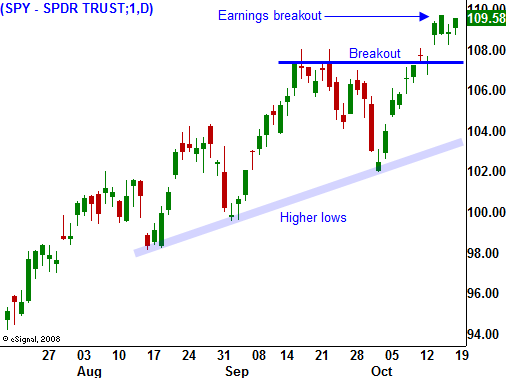

Last week, the market was able to stage a nice little break out to new highs. That happened ahead of major earnings from the largest banks and mega-cap tech stocks.

Goldman Sachs blew estimates away, but the stock did not surge higher. J.P. Morgan Chase, Bank of America and Citigroup also beat estimates and the stocks declined after the news. Consumer lending was a major issue for the nation's largest banks and those concerns will be elevated this week as regional banks post results. Zions Bancorp releases after the bell today.

Intel, IBM and Altera are all trading lower after posting results last week. Google was priced for perfection and they delivered last Thursday. The shares continue to move higher today. After the close, we will hear from Apple. Fantastic earnings are priced in and the stock will be hard pressed to rally even if they smash estimates. Texas Instruments will also release earnings after the close.

Before the open tomorrow, we will hear from many cyclical stocks. Caterpillar, Illinois tool Works, DuPont, Parker Hannifin, and United Technologies will post earnings. The stocks have run up on the promise of improved economic conditions and I do not believe we will see much of an increase in revenues. If guidance is cautious, we will see a pullback in cyclical stocks. Last week, the reaction to GE's number was not very good and the stock is trading lower.

This will be a busy earnings week and 27% of the S&P 500 will post results. We are getting a nice rally today ahead of the news. Bears have been humbled and they will not stand in the way of this freight train.

Building permits, housing starts, PPI, the Beige Book, initial claims, LEI and existing home sales round out the economic releases. Conditions continue to improve gradually and the market is satisfied with "less bad" for the time being. These releases won't have much of a bearing on the market since all eyes will be focused on Q4 earnings guidance.

Interest rates will remain stable through year-end and that means that the key variable to this rally is revenues and profits. That piece to the puzzle will be known to a large degree this week. More importantly, we will be able to gauge the market's reaction to the news. Great results are expected, but to what extent is that priced into stocks?

I believe that we could see some profit taking this week. I am not bearish, but I believe that the next move higher will be hard-fought. If the market is able to hold these levels and the reaction to earnings is positive, I will continue to sell out of the money put spreads. I have a clean slate to work with and I will gradually build positions. If the market stalls and the headwinds are blowing, I will also sell out of the money call spreads. Regional banks and cyclical stocks seem like obvious choices for call credit spreads. In the next day or two, I will know how to position myself based on the price action.

Daily Bulletin Continues...