Nasty Key Reversal On Wednesday Signals Overhead Resistance!

By the end of this week, 27% of the stocks in the S&P 500 will have reported earnings. Results have been good, but that is already priced into the market. Yesterday, the S&P 500 made a new high for 2009 and an intraday reversal pushed it to a new five day low just before the close.

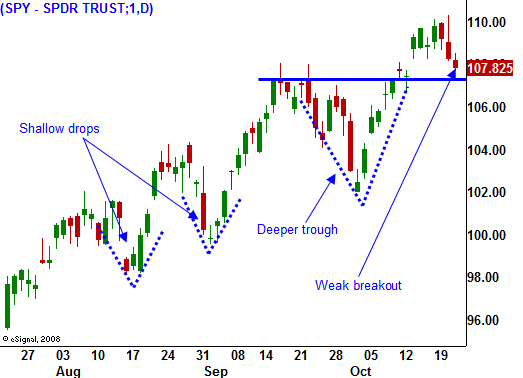

This type of price action tells me that significant resistance is forming. We saw the same type of price action in September and that key reversal resulted in a five-day decline. The most recent dip in September was deeper than the prior two dips and the breakout last week was minimal.

Overhead resistance does not mean that we will see a dramatic decline. There are still many Asset Managers who are under allocated and cash is still flowing into the equity market. This demand for stocks is being met by supply. Traders are taking profits after a 60% rally from the March lows. These two forces will offset each other and the market is likely to fall into a trading range throughout the rest of the year.

The comps from a year ago will be easy to beat, but as time passes, we will be closer to an interest-rate hike by the Fed. Again, these two events will offset each other. The easy money has been made and it is time to shift to a more neutral trading strategy.

Before tomorrow's open, we will hear from Amazon, American Express, Broadcom, Capital One, Western Digital, Honeywell, Ingersoll-Rand, Microsoft, Schlumberger and Whirlpool. Amazon will post decent numbers, but future margin contraction (Wal-Mart is cutting prices) will weigh on the stock. American Express and Capital One will have increasing consumer default rates and the reaction could be negative. This has been an issue with every major bank that has announced. Microsoft has rallied ahead of the release of Windows 7 and this could be a "sell the news" event. All told, I believe earnings could spark some selling on Friday.

Today, initial jobless claims came in at 531,000 when analysts had expected 515,000. Continuing claims dropped below 6 million. The combination was a wash and the market did not react to the release. There are a number of economic releases due out next week and they include durable goods, consumer confidence, GDP, initial claims, Chicago PMI and consumer sentiment. Analysts are looking for a 3% rise in Q3 GDP and that is likely to be the most important economic number next week.

There are great opportunities on both sides of the market. I am selling out of the money call credit spreads on stocks that have rallied with the market but have not produced results when and/or provided decent guidance. I am also selling out of the money put credit spreads on strong stocks that have exceeded expectations and have a positive outlook. The market is likely to chop back and forth within a 10% range (+ or – 5%) through year-end.

Bears have been carried out in body bags and I do not expect to see a huge run-up. They have covered their positions and we will not see short covering rallies. For this reason, I am less worried about a breakout than I am a breakdown. If the SPY breaks below 104, I will start buying back some of my short positions. I will take bearish positions if we break below SPY 102. I don't see this happening, but I need to be prepared.

Daily Bulletin Continues...