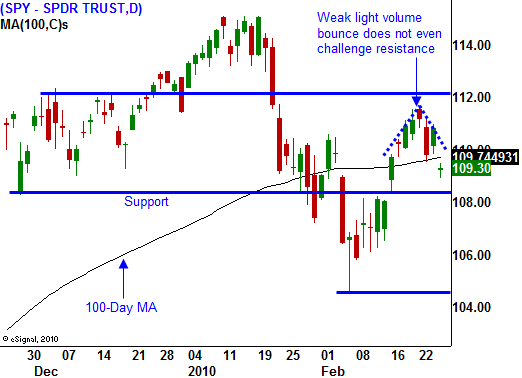

The Headwinds Are Blowing – Wait For A Breakdown Below SPY 108!

A warning shot was fired in January and the market dropped sharply from relative highs. It established support two weeks ago and a half-hearted rally brought us back above the 100-Day moving average. The volume during the decline was much heavier than the volume during the bounce indicating that there was more downside to come.

Resistance at SPY 112 was not even tested before the selling resumed. This morning, the S&P 500 futures are down 17 points on the open. Initial jobless claims were weaker than expected and the employment picture is not improving. In a recent survey (Challenger Gray & Christmas) businesses planned to lay off more workers. This is the first increase since July of last year and with each passing month we are less likely to see job growth. The government will be hiring census workers, but that will be offset by layoffs in the private sector and layoffs by state governments.

Jobs are critical to an economic recovery, however, a bigger problem looms. The EU is in a financial mess. Socialist governments have been spending recklessly and debt levels are extremely high. Although Greece is at the forefront of every news release, it is representative of a wide spread problem.

In order to get financial support from the EU, Greece must drastically cut expenses to balance its budget. It has a few weeks to prove itself and laborers are striking. These protests have turned violent. Greece needs to generate cash and they are afraid that the market won’t support a bond auction. A hefty risk premium has greatly increased their cost of capital.

Many analysts speculate that Germany (the largest EU member) will come to the rescue. Two weeks ago, they announced that their GDP was flat for Q4. This week, in a survey of 7000 businesses, sentiment declined. Tuesday, Commerzbank posted a huge loss indicating that the credit situation is deteriorating. Germany is the largest exporter in the world and I doubt they will come to the rescue when they have issues of their own.

This week, South Korea (the fourth-largest economy in Asia) announced an 8% decline in exports. They have benefited from growth in China and that could be slowing down. In 2010, China has raised bank reserve requirements three times and they are trying to put the brakes on a frothy economy. When all of the commercial projects are finished there will be enough office space for a 5 x 5 cubicle for every man, woman and child in China.

The Chinese have not been using all of the raw materials they have purchased. They have been stockpiling them as an investment. This is simply one alternative to holding US dollars. China has been a big purchaser of our debt, but in the last month they have been net sellers. The Chinese government has advised their citizen to invest in gold. This is not a ringing endorsement of global markets.

This week, the US has held record bond auctions and $126 billion In US Treasuries have been sold. Investors still deem our short-term maturities as a safe place to park money and the auctions have gone well. Our financial situation is dire and in the next five years, we will not be able to pay our bills. Massive changes need to be made to Social Security and Medicare to avoid this disaster. Defense spending also needs to be slashed. Unfortunately, politicians don't have the balls to take the necessary action.

We will continue to head down this path until we are faced with Greece's crisis. This is why so many eyes are focused on this small country. It is a microcosm of what's to come in Portugal, Spain, Italy, Ireland, Bulgaria, Latvia, Lithuania and England.

From a trading standpoint, great earnings and reasonable stock valuations will help the market to tread water as conditions continue to deteriorate. In the next 1 to 3 months, the stress signs will be hard to ignore and a sustained market decline should ensue. It's difficult to say when this breaking point will be reached. I do know that when it happens, the selling will be fast and furious.

Rising unemployment, a slowdown in China, or a credit crisis in Europe are the likely catalysts for a sustained market decline.

Next week, we will get the Unemployment Report. I still feel we are a month or two away from a nasty number. In the next 2-3 weeks, Greece will have to hold a bond auction. The storm is approaching. This market can chop back and forth for a while before it tanks. Wait for a breakdown below SPY 108 and add on weakness.

Daily Bulletin Continues...