A Lack Of Private Sector Job Growth Will Be A Problem This Summer!

The market is extremely resilient. This morning, it was able to shoulder a dismal ADP employment index.

Analysts had expected job growth in the private sector to hit 24,000 and employers actually cut 23,000 jobs. This was a huge miss and for the fourth straight month, analysts have been wrong. Government stimulus has almost run its course and it is critical that we see job creation in the private sector. Corporations have trimmed the fat and they are reluctant to add overhead when the economic recovery is fragile.

For the last week, analysts have been pounding their fists on the table saying that this is the month that job growth will finally materialize. If not for census hiring (200,000), we might not see job growth in Friday's Unemployment Report. The estimates are for 190,000 new jobs.

Overnight, labor statistics were released in Europe. The unemployment rate in the EU rose to 10%, the highest since 1998. Even Germany, the largest EU member, disappointed and their unemployment rate rose to 7.5%.

Factory orders rose .6% and that was better than the .5% analysts had expected. However, Chicago PMI fell to 58.8 in March from 62.6 in February. These numbers suggest that the economic recovery is starting to stall.

The market has completely discounted all of this news and the S&P 500 is flat. This is a bit surprising since great employment news is priced in. Traders tend to view the ADP employment index with a grain of salt. It is of interest, but it can be inaccurate. Traders will wait for Friday's number before they pass judgment.

As I mentioned yesterday, if Friday's number disappoints, we are likely to see a temporary decline. The market will find support and it will look for job growth in April. Earnings season is approaching and the market is likely to rally. The momentum is strong and we saw rallies in October and January ahead of the first earnings releases.

Eventually, the market will get tired of waiting. If it suspects that the employment scene is deteriorating, we will see a sustained decline. It might take a few months for this to happen. States and municipalities have run out of funds and they are laying people off. These job losses will more than offset job gains and we are likely to see the unemployment rate creep higher.

The government has thrown everything at this recession and its war chest is empty. Our national debt is spiraling out of control and additional stimulus proposals will meet stiff resistance. Our economy must grow organically and I don't think it will be able to.

Severance packages and unemployment benefits are starting to run out and consumption will decline. Baby boomers have not saved for retirement and they are not spending like they were a year ago. Last year's warning shot got their attention.

Tomorrow, we will get initial jobless claims, construction spending and ISM manufacturing. These numbers will have a small impact, but most traders will wait for Friday's number.

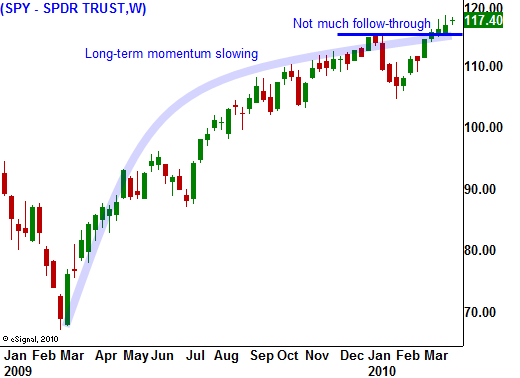

We are in a holding pattern. The market momentum is strong and I don't want to fight it. Earnings have been good and expectations are high ahead of Q1 releases in a few weeks. Economic numbers are softening, but not enough to spark selling. With each passing month, the economic numbers will start to deteriorate and credit issues in Europe will escalate. I will buy puts on a breakdown below SPY 115. Until that happens, I am on the sidelines.

The market has been flat for the last two weeks so we are missing great opportunities. Premium selling strategies would have worked, but the risk/reward ratio was poor. Option implied volatilities are at 18-month lows and one little move in either direction would have resulted in a loss.

For today, I am expecting a quiet day. Bulls have been able to discount the news and the volume is light. We could be dead until Friday’s number.

Daily Bulletin Continues...