This Rally Will Soon Run Out Of Steam!

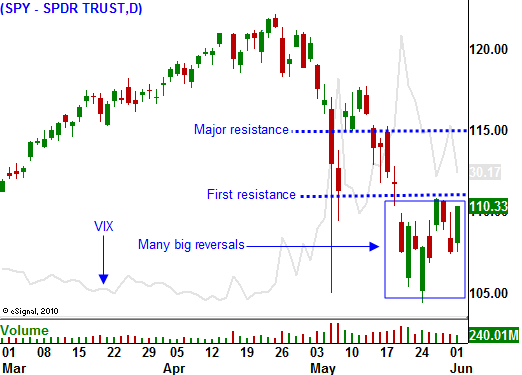

Huge intraday reversals are the norm as bulls and bears battle it out.

Since last Thursday’s monster rally, we have not seen any follow through. Friday looked promising and then Fitch spoiled the party by lowering Spain’s debt rating. Tuesday, prices rebounded after a weak opening and the market traded in positive territory most of the day. Heavy selling set in during the last hour and we closed on the lows of the day.

Yesterday, we finally had a solid rally. Prices continued to grind higher and we closed near the highs of the day. Analysts are very bullish heading into this week’s employment numbers and we did not see late day selling.

This morning, initial jobless claims and the ADP employment index were released. Jobless claims were in line at 453,000. That is a relatively big number and the 4-week moving average is rising. Consensus estimates for the ADP index (55,000 new jobs) were spot on. It measures private sector employment and although the market liked the number, corporations are not rehiring.

Tomorrow, the Unemployment Report will be released. Analysts are expecting 500,000 new jobs. The huge majority of new jobs will come from the public sector and census workers are projected to account for 80% (410,000 new jobs) of job growth. The census workers will only be employed for a few months and they are masking the truth. This is nothing more than a booster shot and they will have a negative impact on employment this fall when the census is finished.

I believe the employment scene will start to deteriorate in coming months and this week’s numbers could mark the peak. Government stimulus is more than half over and all of the census workers have been hired. Each month, the number of state and local layoffs will grow and they will more than offset federal job growth. S&P 500 companies get more than 25% of their profit from Europe and they will delay hiring until conditions stabilize.

This week, ISM manufacturing and ISM services were in line. Both numbers came in well above 50, showing economic expansion. However, I feel these two indicators may be topping out. Manufacturing decreased slightly and services were flat. Inventories have been replenished during the recent cycle and I don’t believe demand is sustainable. This week, China and Europe posted slower growth as measured by PMI.

Retail sales were released this morning and the results were mixed. Consumers are cautiously spending.

The market is desperately looking for “a silver lining”. This week’s statistics have been bullish for the market. There are still those who believe that strength in the US and China can overpower weakness in Europe.

I don’t really care where the strength comes from; I just want to see a rally. That will drain option premiums and it will give us another opportunity to buy puts. The next big move is down.

The major wealth centers of the world are debt laden and they have painted themselves into a corner. When one domino falls, the rest will follow. Credit spreads are starting to rise and they have reached levels not seen since November. Interbank transactions are less “lubricated” than they were a few months ago. This means they are less inclined to do business with each other and that counterparty risk is increasing. If this trend continues, a credit crisis will emerge.

Europe is still very weak and their problem is growing as economic conditions deteriorate. The market feels that sovereign default is inevitable and that it will lead to the breakup of the EU. The Eurodollar continues to get crushed and comments from the ECB/EU carry little weight.

We will get a rally, but I do not believe the market will be able to get above SPY 115. Watch for signs of resistance and start selling out of the money call credit spreads. Also, look for put buying opportunities when the VIX gets below 25. That is still relatively high, but we are not likely to see it drop below 20. Fear has returned to the marketplace and elevated implied volatilities will be the norm the rest of the year.

Keep your bullish trades small and be ready to take bearish positions on a failed rally.

Daily Bulletin Continues...