Market Will Climb A Wall of Worry – FOMC and Flash PMIs Were A Speed Bump

This year the market has fallen more than 100 S&P 500 points and it has snapped back. The volatility is starting to pick up.

We were within striking distance of the all-time high yesterday. Asset Managers are not worried that they will miss the next big rally and they don't want to chase stocks at this level.

The FOMC minutes were released yesterday and traders deemed them to be hawkish. Many members want to continue tapering unless economic conditions sour dramatically.

I mentioned that the flash PMI's could be problematic earlier in the week. Consequently, I have not been overly anxious to get long. China's PMI missed expectations (48.3 vs. 49.5) and Europe came in light (52.7 vs. 53.1). From my perspective, Europe is still recovering and that is bullish. China is a little concerning, but the PBOC could step in. If they don’t, they could miss their growth target of 7.8%.

Initial jobless claims declined slightly and the Philly Fed missed expectations. Earlier in the week, Empire Manufacturing was lower-than-expected as well. For now, traders seem willing to give weaker than expected numbers a free pass. Bad weather has impacted US economic activity.

I believe that macro conditions are still bullish, but the market will climb a wall of worry. That means we should see a two steps forward, one step backwards pattern.

The debt ceiling has been extended, President Obama delayed the ACA by a year for small businesses and corporate profits have grown 7.5% year-over-year. The Fed is tapering, but they are a long way from raising rates. Global credit markets are stable and issues in emerging markets seem quarantined. These are all bullish influences.

When the market gets ahead of itself, we will see profit taking. Traders will worry about a slowdown in China, tighter credit conditions and currency fluctuations in emerging markets.

Asset Managers will not chase stocks, but they will buy dips.

The market typically rallies in January. When it failed to do so this year, a warning shot was fired. At very least, this tells me that 2014 will be challenging to trade.

Once the selling pressure was established yesterday, Asset Managers pulled bids. Speculators took profits on long positions and the market closed on its low of the day. This dip needs to quickly reverse if we are going to challenge the all-time high.

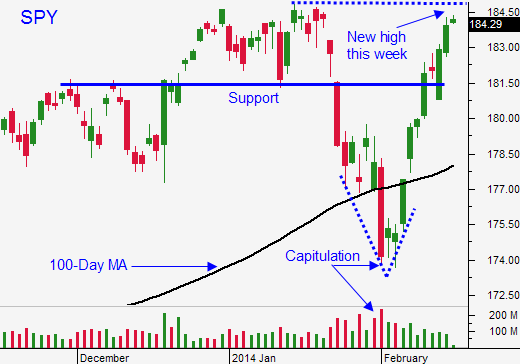

I am long calls and my position is very small. If stocks recover and they grind higher today, I will add to my call positions. I will not get aggressive unless I see a breakout above SPY $185. As long as we stay above SPY $181.50, I am comfortable being long. We do not want to test that support level any time soon.

If the market breaks below SPY $181.50, I will stop out my call positions and I will pivot (buy puts). The probability of this happening is less than 30%, but it would be a bearish sign.

.

.

Daily Bulletin Continues...