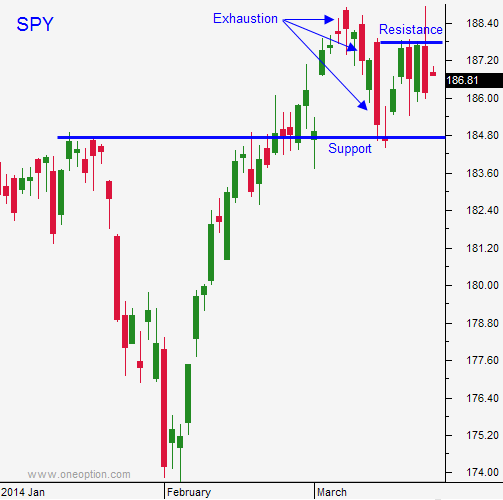

Today’s Close Will Set the Market Tone This Week – Resistance At SPY $187.50 Is Building

Posted 9:30 AM ET - Last week, the market tried to breakout to a new all-time high. Resistance at SPY $187.50 is strong. That level has been challenged four times in four days and in each case the market has pulled back. Resistance is building.

This will be a relatively quiet week. There are not many economic releases (GDP and durable goods) to drive the action. The big news was released before the open.

All eyes are on China's flash PMI (48.1) and it was a low number. The reaction was decent and Asian markets rallied on the notion that fiscal spending will increase. This will slow the slide, but their economy will still decelerate. The PBOC is sidelined. One or two more investment trust defaults are all it will take to spook investors.

The flash PMI's in the EU were okay. France was a little better-than-expected and Germany was a little worse than expected.

Domestic economic releases need to improve. Traders have given the data a free pass due to bad weather. Temperatures are starting to rise and we need proof that this soft patch was entirely weather-related.

Interest rates will start to creep higher. Janet Yellen's comments last week point to higher rates in 2015. Bond funds will not wait for the Fed to take action, they will start adjusting now. This will provide a small headwind for the market.

I don't believe the market will advance until bullish speculators have been flushed out. Asset Managers are not compelled to buy an all-time high. If bulls are not able to force a breakout in the next few days, profit-taking will take hold. After we hit an air pocket, Asset Managers will bid for stocks.

The rally this morning is encouraging, but I don't have faith in the move. The news from China was fairly negative and Friday's reversal should spark additional selling.

If the market declines today, it would mark the second reversal in a row. A pattern where the market opens on its high and closes on its low is bearish. If this happens, we will test support at SPY $185 in the next day or two.

Friday's reversal could have been quadruple witching related. If that is the case, buyers will try to scoop stocks and we could rally back to SPY $187.50. I don't see a catalyst to push us to a new all-time high this week.

As you can tell from my comments, this will be a choppy week. This is a low probability trading environment and we could swing either way. Keep your size small.

I did buy a handful of puts last Friday when the SPY traded below $186.50. I will add to the position if we trade below $185. I will stop the position out if we trade above $188.

Today's finish will set the tone for the rest of the week.

.

.

Daily Bulletin Continues...