Market Could Float To a New High On Light Volume – Happy Memorial Day

Posted 9:30 AM ET (Market Open) - Yesterday, the market started off on a positive note and the momentum grew throughout the day. The FOMC minutes were construed as dovish and stocks finished on the higher the day.

Flash PMI's were released overnight and China came in at 49.7. That was better than expected and economic conditions might have stabilized. If we see signs of pent-up demand in the US, the market will breakout.

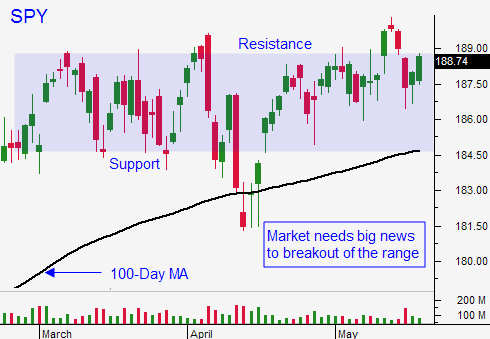

The economic releases are very light for the rest of the month and earnings season is winding down. That means there are not any catalysts to drive the action.

Interest rates are near historic lows and some money will flow into equities due to a lack of investment alternatives. However, stocks are not cheap at a forward P/E of 16 and we will see profit-taking if the market gets ahead of itself. Buyers and sellers are paired off so don’t expect any explosive moves in either direction.

In light pre-holiday trading, even a small bid can push stocks higher. The news and the momentum favor the upside. The market could float to a new all-time high.

I will day trade early this morning and I will call it quits for the week. I sold some out of the money put credit spreads in the tech sector yesterday and I placed my stops.

The action will dry up quickly today.

There is not much news to report so I am not going to post market comments on Friday.

Keep your size small and try to sell some out of the money put spreads.

Take time to honor those who have proudly served our country.

Happy Memorial Day!

.

.

Daily Bulletin Continues...