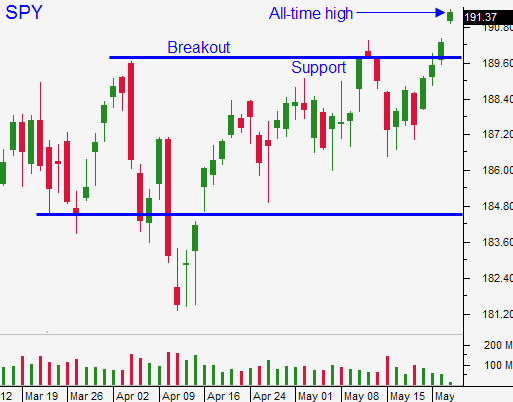

Market Floats To A New High On Light Volume. News Vacuum Favors the Bulls

Posted 10:45 AM ET - The market is breaking out to a new all-time high on light volume. This news vacuum favors the bulls. The momentum has been established and stocks are poised to float higher.

Last week the flash PMI's were better-than-expected. China had the biggest impact and for the time being, conditions have improved. I am hearing rumors that the PBOC could reduce reserve requirements twice in the next few months. Fiscal spending programs will be initiated and that will boost activity.

I still believe that a massive housing bubble exists in China. In a best case scenario, new construction will simply contract, but it won't crash. Even then, a 5% decline in construction will reduce GDP by .6%. China has been the global growth engine and any economic decline will impact the rest of the world.

Conditions in Europe are improving, but GDP is only expected to grow 1% this year. They are coming out of a recession and the recovery is fragile. The ECB will meet on June 5th and traders are expecting a rate cut. That will push interest rates into negative territory and it will be interesting to see the unintended consequences.

We are not seeing signs of pent-up demand in the US. Retailers are reporting dismal results and the guidance has been gloomy. Activity is just good enough to keep sellers at bay.

Durable goods orders came in better than expected this morning (.8% versus expectations of -1.1%). This is a volatile number and the economic news will not pick up for another week.

Interest rates are near historic lows and Fed officials are suggesting that they might extend tapering and start tightening before it ends. That would make the transition smoother. Rates should be moving higher in this environment, but they are not. That tells me that the "smart money" does not believe the pent-up demand theory or it means that they are in risk off mode (possible correction or credit crisis).

We have a bona fide breakout and you can buy a few calls. Use SPY $189 as your stop and keep your size small.

The market might have one more good push left in it. Stocks are fully priced and I'm not expecting a run-away rally.

I am day trading and I sold some put credit spreads last week. I will not embrace this rally until I have proof that economic conditions are improving.

We need to see some big numbers next week or we will fall into a tight trading range (summer doldrums). After this round of news, the calendar is light until Q2 earnings season.

.

.

Daily Bulletin Continues...