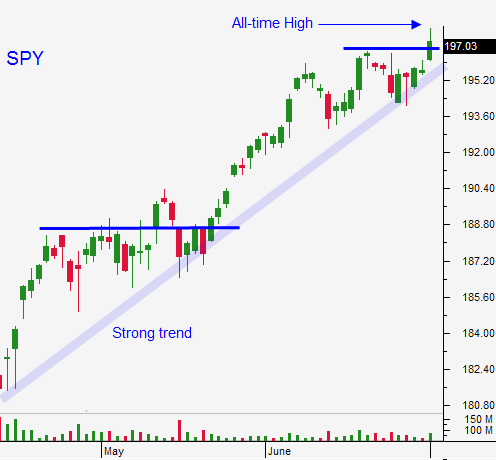

Jobs, Jobs, Jobs – This Is the Confirmation We Have Been Looking For – Buy Calls

Posted 9:25 AM ET - WOW - the Bureau of Labor Statistics said that 288,000 new jobs were created in June. That was much better than expected and it is the second strong number in a row. Furthermore, ADP said that 281,000 new jobs were created in the private sector. Challenger Gray & Christmas reported that planned layoffs will decline month over month. These are all positive developments.

Sustained job growth can fix many of the market concerns. As household income rises, consumption increases. Corporations are lean and mean and any uptick in demand will go straight to the bottom line. Earnings will expand and P/E ratios will decline. This could start an expansion cycle.

Interest rates will creep higher, but this is a healthy sign. As long as economic conditions improve, the market will tolerate higher yields.

Global manufacturing PMI's were better-than-expected and we learned that the service PMI's were also strong. ISM services will be released at 10 AM ET and we should get a good number.

The data points are improving and this could be an inflection point.

It takes a few data points to establish a trend so try not to get too excited. I bought calls yesterday and I'm adding to the position today. I don't want to load up ahead of a holiday weekend, but I will add next week.

Earnings season kicks off next week and banks dominate the early action. Higher interest rates are good for the financial sector and banks should move higher.

The early action will be brisk and the activity will dwindle quickly. Buy some calls and add next week.

Today's report will raise spirits

Happy Fourth of July!

.

.

Daily Bulletin Continues...