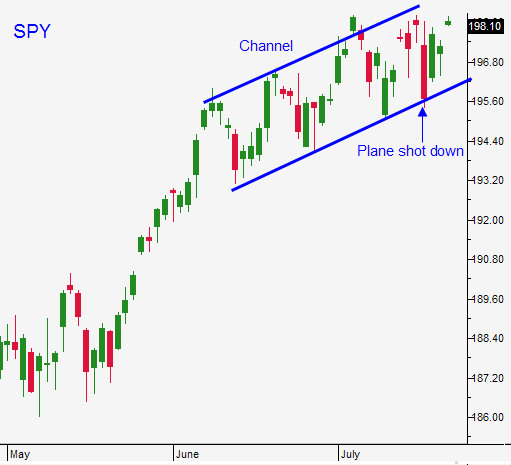

New All-Time High – Stay Long. We Should See Strong Price Action Through July

Posted 9:30 AM ET - Last Thursday, the market sold off on political conflicts in the Ukraine and Gaza. Asset Managers did not waste time. They immediately scooped stocks and those losses were erased.

Earnings season is in full bloom in the results have been good. Revenues are up 3.5% and profits are up 7% for companies that have reported. Apple and Microsoft will post results tonight.

Banks were priced for dismal performance and the news was better than feared. The financial sector has been moving higher.

Cyclical stocks are catching a bid. Alcoa posted strong results and growth in China is back on track (7.5%).

UNH posted better-than-expected results and HMOs are moving higher.

Intel and Google set a positive tone for tech. These stocks have run up and they have been able to hold the gains.

Employment conditions are improving in the US and corporate guidance should be optimistic for Q3. This is one of the catalysts for this rally.

Flash PMI's will be posted on Thursday. Expect strong results in the US and China. Europe will be soft.

Asset Managers did not participate in the light volume rally that started in May. They wanted proof that an economic recovery was underway and now they have it. Every dip has been a buying opportunity and the market is going to make a new high today.

If you followed my advice you bought some calls. Stay the course and raise your stop to SPY $197.

.

.

Daily Bulletin Continues...