Tech Giants Post Good Results – Market Will Make A New All-time Closing High Today

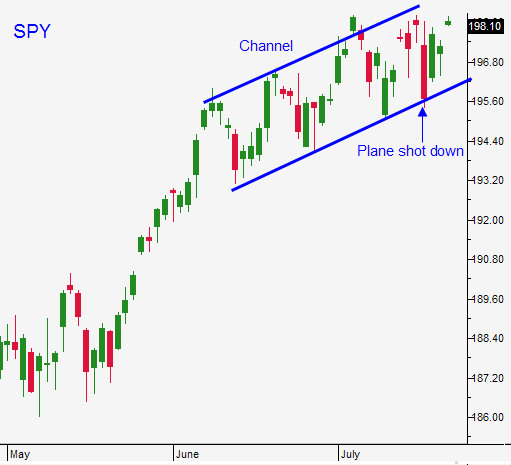

Posted 9:30 AM ET - Last week's tragic airline crash in the Ukraine allowed us to gauge the market bid. The S&P 500 dropped 23 points on Thursday and buyers instantly snapped up shares on Friday. Asset Managers patiently waited for proof of an economic recovery and they did not participate in the light volume rally that started in May. Now they are playing catch-up.

The US job recovery has been confirmed through multiple sources over a period of months (ADP, initial claims, Challenger Gray & Christmas, JOLTS and the Unemployment Report). Next week, we will learn if the trend is still on track.

ISM manufacturing, ISM services, GDP, ADP and the Unemployment Report will be released. The FOMC will also meet. I am expecting good economic results and dovish statements from the Fed.

Tomorrow, flash PMI's will be released. China and the US will be strong – Europe will be soft. The ECB is considering QE and that should calm nerves. The global reaction should be market friendly.

Earnings season is off to a great start. Revenues are up 3.5% and profits are up 7%. Tech has been able to tread water after recent gains and this is important for the overall market. INTC, GOOG, AAPL, MSFT and VMW posted good results.

Bad news was priced into the financial sector and banks have been moving higher after posting better than feared results. Cyclical stocks are catching a bid (CAT and MMM post tomorrow). UNH posted solid results and the healthcare sector looks strong. Biotech and pharmaceuticals are also moving higher.

Tensions in the Ukraine and in Gaza continue to build, but the market does not care. The only thing that could possibly spoil this rally is a credit crisis (I don't see that threat at this time).

We bought calls last week and we raised our stop up to SPY $197. This stop will lock-in profits if it is hit.

The overnight news was positive and the market should make a new all-time closing high today. The bullish price action should continue through July.

Stay long and keep moving your stop up as the market makes new highs.

.

.

Daily Bulletin Continues...