Strong Economic Data Will Push Interest Rates Higher – FOMC Will Not Spook the Market

Posted 10:30 AM ET - This is a critical day for the market. Major news releases will impact trading.

This morning, GDP came in at 4%. That is a remarkable recovery given that it was down 2.9% in Q1. This number could be a little too good. Traders will start to worry that strong economic activity will push interest rates higher. Since the open, the market has drifted lower.

ADP said that 218,000 new jobs were created in July. That number was in line with expectations and it is down from 288,000 last month. This was a perfect number ("not too hot, not too cold").

The FOMC will release its statement this afternoon. They will be in recess until September 16th and they don't want to spook the market. Consequently, their comments should remain unchanged. They will continue to taper, but they won't introduce alternative tightening measures.

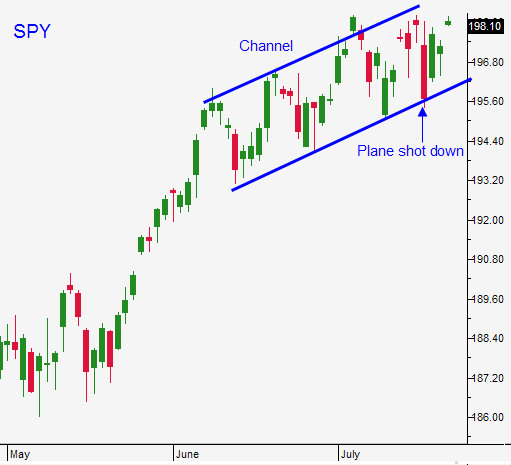

Strong economic data could weigh on the market in coming weeks. Stocks don't typically do well when the Fed is in recess. I don't believe we will see a major decline, just a temporary soft patch.

Asset Managers did not participate in the light volume rally that started in May. They waited for strong economic data and now they have it. The bid to the market is strong and buyers will return once this soft patch runs its course.

When October draws close, the selling pressure will increase. Once tapering ends, the focus will immediately shift to tightening. September is a seasonally weak month for the market and that is when we could see a small correction.

For the time being, wait for the dip. I am currently in cash.

If the market reaction to the FOMC statement is bullish, I will day trade from the long side but I will not buy calls. If the market declines on the news, I will patiently wait for support. The uptrend from April needs to be preserved. Once the selling pressure subsides, I will buy calls.

Earnings have been excellent. More than half of the S&P 500 has reported. Revenues are up 5% and profits are up over 8%.

The market could swing either way on the FOMC statement. Stay sidelined and wait for the reaction.

.

.

Daily Bulletin Continues...