Durable Goods Did Not Move the Needle – Look For Quiet Trading With An Upward Bias

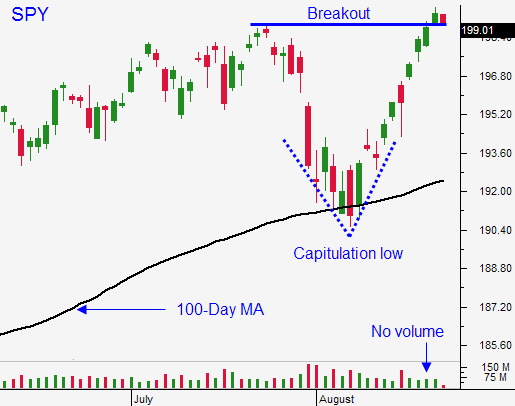

Posted 9:50 AM ET - The S&P 500 is above $2000 and it is making a new all-time high. The news is light and so is the volume. The path of least resistance is up and stocks will float higher the rest of the week provided that geopolitical conflicts remained stable.

The ECB plans to start QE in September. China is considering stimulus/easing to keep their economic growth at 7.5%. Janet Yellen said that structural unemployment issues will keep the Fed from tightening anytime soon. Central banks are "loose" and that is pushing the market higher.

U.S. Treasury yields are at historic lows. Bond Managers are not worried that interest rates will start moving higher when tapering ends in October.

Earnings season is over and the results were strong. Revenues were up 5% and profits were up 8%. Corporations are lean and mean and any uptick in demand will go straight to the bottom line.

DC is in recess and "no news is good news".

Durable goods orders fell .8% (ex-aircraft). This release did not move the market. GDP will be posted on Thursday and it should not have much of an impact either.

I exited my put position yesterday. It was tiny and my losses were small.

I am ready to call it a week. Day trading is tough when you don’t have movement. Yesterday, the S&P traded in a 2 point range the last 3 hours of the day.

Trading activity will continue to decrease the rest of the week.

September is a seasonally weak month. Good news is priced in and one negative release could spark a swift decline. I will watch from the sidelines until the volume returns.

If you are long calls, use SPY $199 as your stop.

Expect quiet trading and tight ranges with a slight upward bias the rest of the week.

.

.

Daily Bulletin Continues...