FOMC Will Keep A Lid On the Market – Traders Will Get Nervous Ahead of the Statement

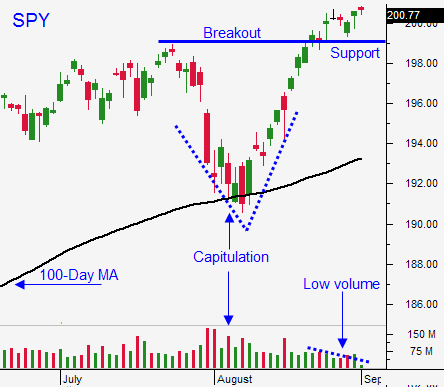

Posted 11:20 AM ET - The market is struggling to tread water at this level. The S&P 500 ran up to an all-time high on light volume and it needs time to consolidate. There are a few speed bumps ahead and I believe we will see a small pullback over the next few weeks.

The FOMC will meet on September 17th and investors will get nervous. Many analysts believe that the phrase "considerable time" might be removed from the statement because recent economic releases have been strong. If the language is removed, it is a sign that the Fed might tighten before May 2015.

As soon as the bond purchase program ends in October, the focus will shift to tightening. Even if the Fed remains accommodative, Bond Managers will sell bonds on strong economic news. This will push interest rates higher and the market will go through an adjustment phase as the five-year trend reverses.

Last Friday's Unemployment Report missed expectations by a wide margin, but I don't believe anyone trusts the number. It is contrary to every other economic release we've had in the last two months.

The debt ceiling will also come into play in the next few weeks. Republicans want to stay out of the headlines ahead of the November elections. The debt ceiling will be raised at the final hour and the political banter will keep a lid on the price action.

HMOs will announce rate hikes in the next few weeks. Many analysts believe the premiums could go up 15%+ due to increasing Obamacare expenses. This will impact businesses and individuals.

There is also a potential speed bump tomorrow. Apple will announce its new product line. The stock has been moving higher and this is typically a "sell the news" event. The stock does have the potential to impact the market.

All of these issues can be resolved over time. The greatest threat is a spike in interest rates. As long as the move is gradual and economic conditions continue to strengthen, the market will be able to push higher into year-end.

September and October are seasonally weak months. I believe we will test the 100-day moving average in the next few weeks. Once support is established, we will grind higher into year-end.

I was able to breakeven on my call trades last Friday and I am happy to be on the sidelines. The FOMC is approaching quickly and I believe we will see nervous, choppy trading into the release.

I am going to focus on day trading. The closer we get to the FOMC, the more I will focus on the short side. I don't think the market will be choppy some not going to take any overnight positions.

If you're hanging onto your calls, use SPY $199 as a stop.

.

.

Daily Bulletin Continues...