Market Wants To Run – Use This Tactic To Manage Your Positions

Posted 10:00 AM ET - I recorded this trading video last Thursday during market hours. I looked for new trades using the system and I executed trades. Look at how the highlighted stocks have done since Thursday.

CLICK HERE TO WATCH THE VIDEO

Yesterday, the market continued to climb. I don't see any spoilers on the calendar this week and we should grind higher. Underinvested Asset Managers are getting nervous and bullish speculators are piling in. You should have all of your bullish positions on and we are shifting into management mode.

In my comments yesterday, I mentioned that I'm not going to tell you to get long. The train left the station and if you have been following my advice, you are on board.

Yesterday, I got a good question from one of my system subscribers. "You tell us that we should manage our current positions, but what happens when your system gives a new buy signal for a stock?"

This is a great question. Each day I review my positions. I am not as worried about my put credit spreads because they simply need to maintain a support level between the stock price and the short strike price. As long as they do, I don't worry about them. On the other hand, my call positions have to be monitored very carefully.

When you buy premium, you have time decay and possibly a decline in volatility working against you. If you are long in the money call options with a high delta, the options move point for point with the underlying stock and you have that risk as well. You need to make sure that the momentum is still intact. I look for two things, relative strength and exhaustion.

If the stock does not typically make big moves, and you've had a nice run, prepare to take profits when the momentum slows. Watch how the stock performs relative to the market. For bullish positions, I want to see the stock hold its own when the market is selling off. When the market is flat I want to see the stock inching higher. When the market is in rally mode, the stock should be leading the way.

When the stock is losing its mojo, take profits and look for the next opportunity. I like exiting trades that have been on a nice run and then I use that money to buy calls on a stock that is just breaking through horizontal resistance. These breakouts tend to have sustained moves that last at least a few days.

Use this tactic and you will be able to take advantage of new trade signals without increasing your overall risk exposure.

The same holds true for positions that are not producing. If I'm in a call position and I expected the stock to take off, I exit the calls in a day or two if the move fails to materialize (especially if the market ran higher).

A good example is Microsoft. Our system gave a buy signal on 11/4. I bought in the money calls on the horizontal breakout through $47.50 and I rode the stock higher. MSFT stalled and the market was moving higher so I took profits yesterday. Microsoft does not make big moves and this one might have run its course.

I hope today’s comments help you manage your positions.

I don't have much to add to my market comments. The news has been excellent and the market should grind higher.

The next big release is Thursday. China's numbers should be good. On Friday, we have EU GDP, retail sales and Fed Speak. This news might have a slight negative tone to it, but it will not spark a big round of selling. I am expecting brief, shallow probes for support that last a day at most.

The bid is strong. We are seeing a bullish pattern where stocks are weak on the open and the bid strengthens throughout the day.

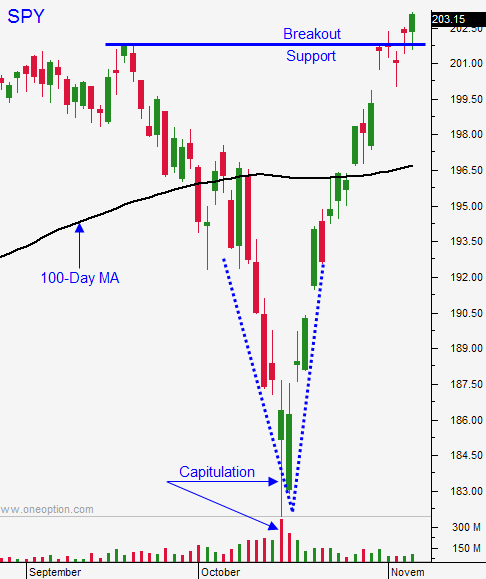

Look for a grind higher. Stay long, manage your positions as described above and raise your stop to SPY $202.50

.

.

Daily Bulletin Continues...