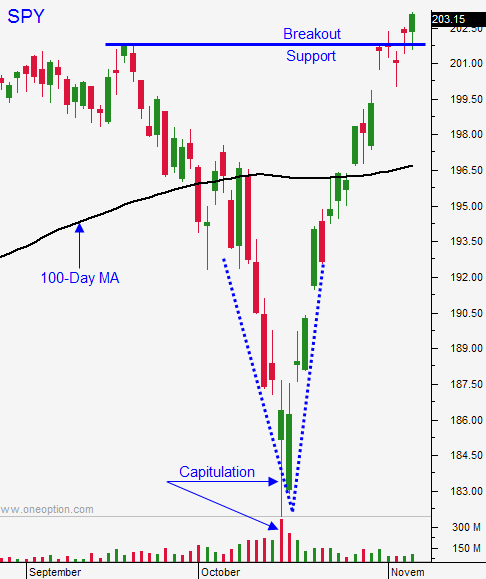

Market Dip Will Be Brief and It Might Not Last More Than a Few Hours – Stay Long

Posted 10:10 AM ET - This morning, we are getting tested. The S&P 500 is down seven points after 30 minutes of trading. The overnight news was benign and this is nothing more than a probe for support.

The US and China signed trade agreements yesterday and that is bullish. Germany believes that economic conditions are stabilizing and that bodes well for their GDP number on Friday.

China will post GDP, industrial production and retail sales tomorrow. The numbers should be in line with expectations.

Macy's missed on the top line, but they beat on the bottom line. Same-store sales were down 1.3% and they lowered guidance. Surprisingly, the stock is up 2% this morning. Domestic retail sales will be posted on Friday and analysts will be trying to see if lower gasoline prices are stimulating consumption.

The macro backdrop is still very bullish. Profit-taking will be minimal and Asset Managers still want to get long.

I believe the dip this morning will be very brief and it might not last more than a few hours. We have seen a daily pattern of early weakness and late strength. This is also bullish.

Maintain your long positions and use SPY $202.50 as your stop on a closing basis.

The S&P has rallied 3 points since I started writing this and I would not be surprised to see us finish in positive territory.

.

.

Daily Bulletin Continues...