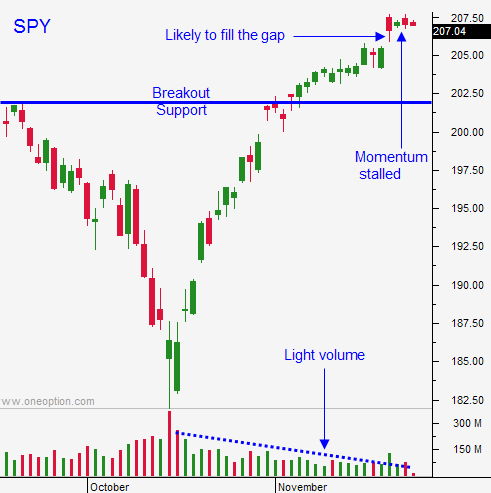

Take Profits On Your Calls Before the Weekend – Wait For A Dip

Posted 9:40 AM ET - Yesterday, the market took a breather and the range was very tight. We can expect the same the rest of the week.

GDP came in better than expected (3.9%) and durable goods orders declined .9% (ex-transportation). These numbers were a wash.

Major economic releases lie ahead next week (ISM manufacturing, ISM services, ADP and the Unemployment Report). Domestic activity has been solid and the numbers should be in line. Any surprise favors the downside since good news is priced in.

The market has a tendency to rally into Black Friday and to selloff on Cyber Monday. I am not going to place any big bets on this pattern, but I am going to exit all of my call positions before the weekend. I am down to 20% of my maximum position size and I will exit half of the calls today and the other half on Friday.

I have been selling some out of the money call credit spreads on stocks that have run up and are hitting resistance. My size is fairly small.

I am not bearish; I am just trying to be prudent. This is been a great run and I want to lock in profits.

Asset Managers won't chase stocks at an all-time high and bullish speculators are ripe to get flushed out. A small two day decline would do the trick. At best, the market will tread water. Calls will lose time premium and I believe I will be able to re-enter at a better price.

I don't see any speed bumps next week.

Take profits on your call positions.

Many in your family have a safe and healthy holiday.

Happy Thanksgiving!

.

.

Daily Bulletin Continues...