GDP Was Dismal – FOMC Will Soften the Blow – Get Ready To Buy Puts

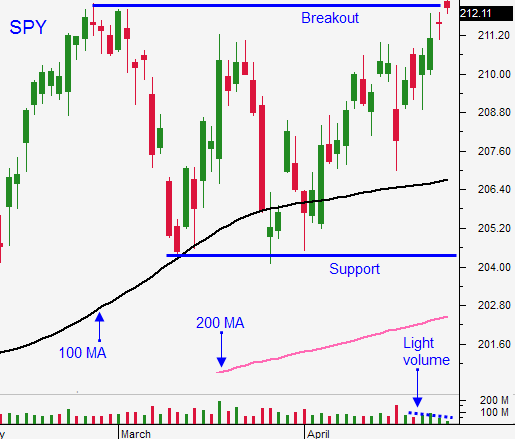

Posted 11:15 AM ET - The market is showing signs of exhaustion. The S&P 500 opened at a new all-time high Monday morning after strong results from mega cap tech stocks. As the day wore on, the breakout failed and stocks drifted lower. Resistance is formidable.

Apple posted fantastic results after the close Monday and that should have sparked buying. Instead, the price action was very soft yesterday.

The S&P 500 was down 15 points before the open today. Q1 GDP came in at a dismal .2%. That is much worse than expected. Not to worry, analysts will dismiss this as weather related. That argument did hold water when we had the polar vortex in 2014. Economists were expecting pent-up demand and it never materialized.

The FOMC will soften the blow when they release their statement this afternoon. They know economic conditions are weak and the tone will be dovish. The market could stage a nice little rally on the news, but that move will quickly stall.

For weeks I've been pointing out that traders are worried about a tiny little quarter-point rate hike when they should be worried about economic growth. Domestic activity is barely treading water.

Earnings from this point on will not generate excitement. Energy stocks will start posting and the numbers will be weak. I'm also expecting soft results from retail and restaurant. Minimum wage hikes and weak consumer demand will impact profits. Stocks are trading at a forward P/E of 18 and they are rich.

I will day trade from the short side ahead of the FOMC and I have purchased puts. If we get a rally after the FOMC, I will wait for it to stall and I will buy more puts. If the market has a negative reaction, I will add right way if the statement is unchanged (likely). If there are changes, I will let the dust settle for 10 minutes.

I would like to see a close below SPY $210. Follow through selling and an easy breach of the 100-Day MA ($206.80) would prompt me to buy more puts.

The stop on my shorts is a close above SPY $212. That is the all-time high and we are very close to it.

.

.

Daily Bulletin Continues...