Start Taking Profits On Calls – Resistance Will Build As the All-time High Is Challenged

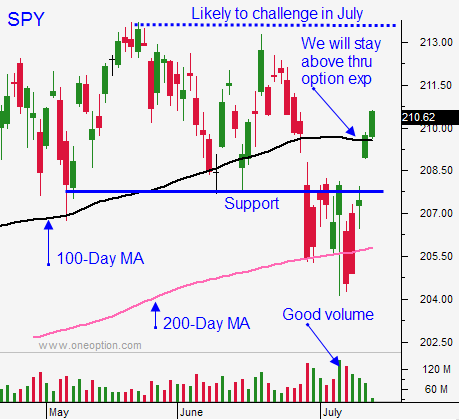

Posted 8:30 AM ET - The market tried to rally Wednesday, but comments from Janet Yellen sparked some light selling. She said that baring any surprises, the Fed would raise rates at least once this year. The 100-Day MA was never in jeopardy and we will stay above it this week.

I know that Greek riots were blamed for the pullback yesterday, but any logical person should have expected that after the concessions were made. Either way (deal or no deal) there would have been rioting.

Chinas trade balance improved and GDP/retail sales were better than expected. Their market sold off yesterday and it is bouncing back today. For the next week, the price action should stabilize.

With China and Greece behind us temporarily, the market will focus on earnings. They will be good, but not great. Mega cap tech stocks will need to lead the next leg of this rally. Google posts after the close today.

The economic news is light next week. Flash PMIs will be posted a week from Friday and that is the next big release.

If you are long calls, take some profits. I predicted 3-4 days of positive price action and we got it. The market momentum will slow and that makes it more difficult to own calls. Selling out of the money put spreads is still the way to go. Wait for a strong earnings announcement and a horizontal breakout. Then sell OTM put spreads below the breakout. Use the breakout as your stop.

Day traders, I would not jump on the early rally this morning. Make sure the gains hold before taking new long positions. If we are able to make a new high for the day after the first hour, we will grind higher. Resistance at the all-time high is stiff so the upside is fairly limited at this stage.

AAPL reports next Tuesday and that will keep buyers engaged.

Stay long, but start taking profits on call positions.

.

.

Daily Bulletin Continues...