Major Support Broken – Look For Bearish Price Action the Next 3 Weeks – Use This Tactic

I RECORDED THIS VIDEO THURS MORNING - PLEASE WATCH IT

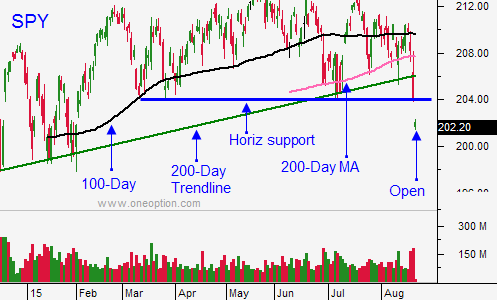

Posted 9:40 AM ET - For the last few weeks I've been warning you of an August decline. Stocks sold off hard yesterday and major technical support levels were breached. They include the 200-day moving average, horizontal support and the 200-day up trend line.

China's flash PMI was weaker than expected (47.1 versus 47.8 expected). Without question, the world's largest economy is slipping and it will have a ripple effect. The greater danger is a credit crisis in their shadow banking industry.

Although the number was bad, it wasn't a disaster. Furthermore, Europe's flash PMI was better than expected. Europe is only growing at a .3% clip so take that with a grain of salt.

The market will probe for support this morning. Option expiration could exaggerate the move, but I believe most traders adjusted risk yesterday.

In recent months we've had some nasty one day declines. In half of those cases, the market has snapped back the next day. In the other instances, there has been slight follow-through selling the next day and then there has been a massive snapback rally on the third day.

We have broken major technical support and we should see negative price action for the next three weeks. However, bear markets do not go straight down. They are marked by nasty declines and vicious snapback rallies.

You need to exit bearish positions when we hit an air pocket. Wait for a snapback rally and reload. This will be a three steps down and one step back process.

I bought GLD calls last week and those are in great shape. I plan to take profits on half of the position today. Yesterday I purchased ITM VXX calls in September and I will keep that position on for the next few weeks. VXX is near historic lows and as long as the market is trending lower, they will increase in value. Eventually, we will get a nasty washout and implied volatilities will spike. This trade is fairly easy to hang onto and I will wait for that moment.

I took big profits on my puts yesterday on the notion that I would get a chance to reload this morning. The S&P is down 11 points before the open and we might find support after an early plunge. I would have preferred a failed bounce on the open this morning. I could've shorted that with ease and waited to gauge the selling pressure.

If we make a new low after one hour of trading, we are likely to drift lower all day. If we hit another air pocket, take profits on put positions today. We are likely to open higher on Monday if we sell hard today and you can evaluate without taking a lot of risk over the weekend.

If the market drops substantially in the first hour and it recovers most of the losses, we are not likely to move lower today. In fact, we could rally a little bit.

This is the first time in many years that we will close below the 200-day moving average for a prolonged period of time. My outlook for the next three weeks is bearish. I will be looking for opportunities to get short on snapback rallies.

If you are long puts, congratulations. Take profits if we get a deep early drop today.

.

.

Daily Bulletin Continues...