Market Will Rally Thru Labor Day – Buy Now and Don’t Be Shy

If you want my market comments everyday before the open, GET MY TRADING PLATFORM. I don't have time to post to my blog when the market is going crazy and that is when most of you need guidance. We made a killing yesterday and this is the best $.60 a day you can spend.

Posted 9:30 AM - There are a few times a year when you can swing for the fence - this is one of them. Sell puts and buy stock. You can also sell puts and use the proceeds to buy calls. Option implied volatilities are high so make sure you don't just buy calls.

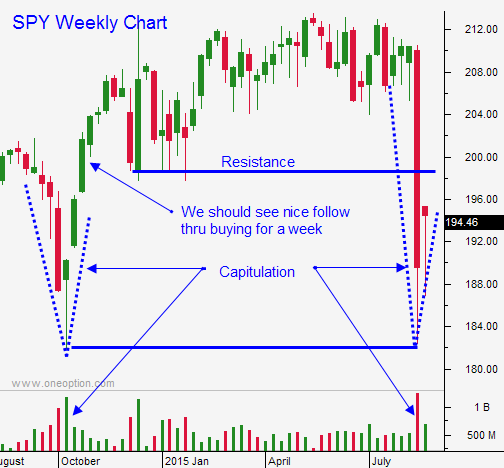

Tuesday the market tried to retest the lows from Monday and the reversal was sharp. Buyers stepped in before SPY $182 was tested. Wednesday, the early gap higher started to crumble. Asset Managers were not going to bid until they saw support. As the day wore on, the selling pressure subsided. Stocks gradually started to climb and then they exploded higher.

Asset Managers wanted to buy as much as they could before the close knowing that the rally would continue this morning. Stocks are gapping higher and I we will not see much of a dip this morning. Confidence is growing and anyone who missed the rally yesterday will aggressively buy stocks this morning. I am expecting strength through Labor Day.

I got long yesterday after a few hours of trading and I was stopped out for a loss. I knew that prices were going to move higher and I waited for the next support level to be established. I did not hesitate when I saw the early stages of the rally and I loaded up. This was not my first rodeo and I knew buyers would be gobbling everything up right into the closing bell.

Those of you who frequently read my comments know that I vary my trading size based on probability. Do not keep your size constant! I considered this to be an extremely high probability trading environment. Each year I look back at my P&L and a handful of days stand out. Yesterday was one of them and the move is not over.

China is not falling off a cliff and they are doing everything they can to support the market. These efforts will have a temporary effect, but I only care about the next few weeks.

Fed officials will be making comments in Jackson Hole and they should be dovish.

I believe that a September rate hike is off the table now. That means that we probably won't see higher rates until March. Some analysts will believe that today's GDP (3.7%) will keep the September hike alive and we could see nervous trading just before the FOMC. That is not a concern for a couple of weeks.

I see clear sailing ahead for the next two weeks and we finally have an opportunity to swing trade. Sell puts and use the proceeds to buy calls. Hold these positions for at least a week. We should have a nice steady grind higher.

Get long early today and add on strength. Don’t be shy; I will be trading large size.

.

.

Daily Bulletin Continues...