Expect Wild Overnight Moves Into the FOMC – Great Environment For Day Trading

CLICK HERE TO SEE WHAT TRADERS SAID ABOUT MY CHAT ROOM

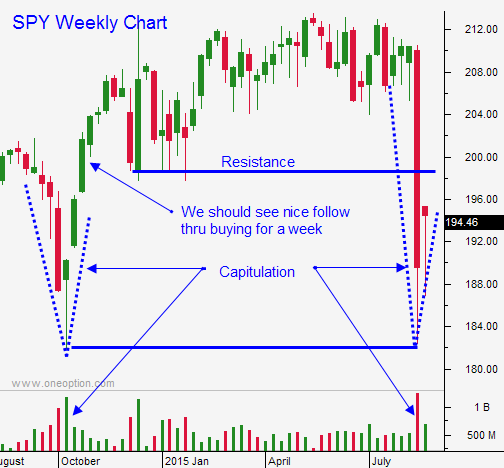

Posted 11:00 AM ET - Yesterday, the market gapped higher and it held the early gains. Buyers stepped in and we closed on the high. This morning we are getting a little follow-through.

China's market is closed the rest of the week and that is one less thing to worry about. Their government has been buying stocks and the PBOC has devalued the Yuan, lowered bank reserve requirements and cut rates. China's economy is not falling off a cliff and these measures should attract buyers.

Domestic economic releases have been good. ISM services came in at a very healthy 59 today. Friday's jobs report should be in line after ADP reported 190,000 new jobs in the private sector during the month of August.

The overnight moves have been severe and it doesn't make sense to swing trade this market. You can't sell premium because option implied volatilities will stay elevated through the FOMC meeting on September 17th. That is two days before quadruple witching and we will see wild price swings into expiration Friday.

I have been day trading. If the market is above the high from the first hour, I favor the long side. If the market is below the low from the first hour, I favor the short side. Once the momentum has been established, we typically see follow-through in that direction the rest of the day.

We are in pre-holiday mode and the volume will drop off.

If you are a swing trader, keep your powder dry. If you are a day trader, use the tactic outlined above.

Expect random overnight moves until the FOMC meeting.

.

.

Daily Bulletin Continues...