Look For A Capitulation Low – Bid Will Strengthen By the End of the Week

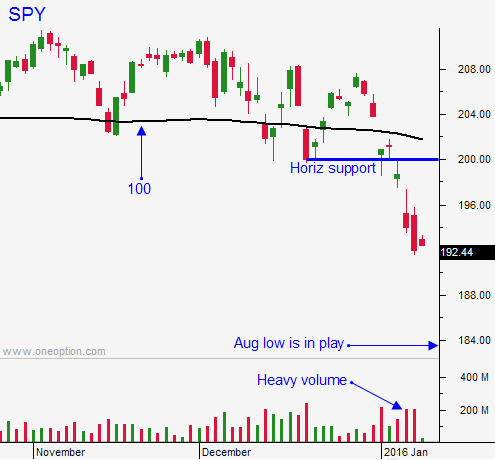

Posted 9:50 AM ET - Last week the market broke major support levels as Chinese panic selling escalated. The Yuan was crushed and investors sold Chinese bonds. Chinese investors wanted to avoid capital gains in 2015 and they unloaded stocks the first chance they got. This triggered circuit breakers and panic selling ensued.

China's official PMI's were decent. Tomorrow, they will post trade numbers and a week from tomorrow they will post industrial production/retail sales. These will be important events.

Central banks love to screw with shorts and option expiration presents the perfect opportunity. I believe the PBOC will take action this week.

Domestic economic releases were good. ISM services was above 55 and that is a strong number. ISM manufacturing was below 50, but manufacturing only accounts for 20% of our economic activity. ADP was strong and the jobs report Friday came in at 292,000. That was much better than expected and the numbers for November and October were raised as well. US economic conditions are stable.

Stocks opened higher last Friday and they reversed the rest of the day. Some traders suspect that the news was too hot and that the Fed will hike soon. From my perspective, we need good economic news if the market is going to tread water this year. The Fed knows conditions are fragile and they will postpone the rate hike as long as possible.

Earnings season will kick off today. Bad news is priced in and the bid will strengthen towards the end of the week. The strongest companies announce early in the cycle and I believe the market will bounce soon.

The early rally this morning feels good, but we need to make sure it holds. If we test the downside early and the selling is brief, we can get long. If the market makes a new intraday high after a couple of hours of trading, we can get more aggressive. This is the same set of instructions I outlined Friday. We kept drifting lower, so we had to be patient.

I still believe that we will see weakness in the next day or two. I want to see a deep air pocket and a sharp intraday reversal. That will be a sign of capitulation.

We have been trading from the long side the last week and making money during the bloodbath. The pattern we trade is very powerful and we will stick to this strategy. This week we have a chance to catch a nice rally and good trades have the potential to turn into incredible trades.

If you are long puts, you should consider taking profits in the next few days. Option IVs are juiced and we are due for a bounce.

Stick to day trading and wait for signs of support. The bid should strengthen towards the end of the week.

Don’t take overnight longs until we see signs of support and late day buying a couple days in a row.

.

.

Daily Bulletin Continues...