Use This Strategy To Day Trade – Market Will Tread Water Next Week

1 WEEK FREE TRIAL - SEE WHAT WE ARE TRADING IN THE CHAT ROOM

Posted 9:00 AM ET - The S&P 500 has rallied 100 points from the low a week ago. Prices feel a little stretched and gains will be hard-fought. The news is light next week and trading could be quiet.

Yesterday, stocks fell into a tight range and the price action was very choppy. Options expiration will not be a factor today.

Much of the rally can be attributed to basic materials and cyclicals. The long-term fundamentals are very bearish for these companies and this was nothing more than a bounce. If you want to trade from the short side, watch these stocks. Once the bounce stalls and relative weakness is apparent, you have an excellent opportunity to sell out of the money call credit spreads. You can also day trade the stocks from the short side.

I still prefer to trade from the long side. I'm able to find many stocks that have been badly beaten down and that have yet to bounce. I'm looking for solid bases and a breakout through horizontal resistance. I have been selling out of the money bullish put spreads on these stocks (many will expire today) and I have been day trading them from the long side.

The keys to trading from the long side today are as follows. First of all, wait for the market to pullback and for support to be established. When the market bounces we will have the tailwind we need for bullish day trades. Secondly, line up your stocks and look for relative strength. I prefer to buy stocks that have pulled back and compressed. Once they release, I have an excellent day trading opportunity. I don't like buying stocks that are grinding higher. When you buy a new high of the day, you often see quick pullbacks that can shake you out of the position. Finally, set targets and take profits. We won't have a market tailwind today and we are back in hit and run mode.

Flash PMI's will be released Monday, but the news is light the rest of the week.

This bounce has been bigger than most people (myself included) expected. I feel like I'm walking on thin ice and I don't trust the rally.

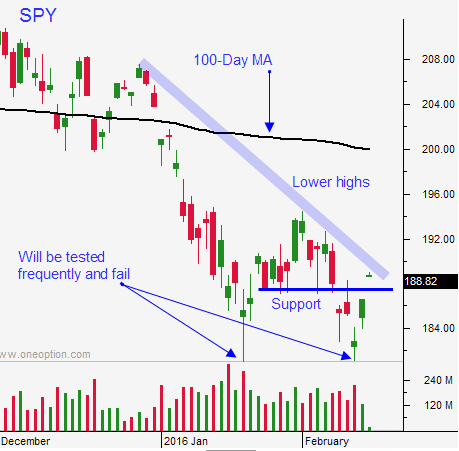

On a longer-term basis, I believe the market will continue its decline. We will challenge SPY $182 with greater frequency and it will fail.

We could be in for a quiet stretch next week. The PBOC and BOJ eased and the Fed is not likely to hike before June. Earnings have been okay and we are above support at SPY $187.50. These factors will help the market tread water next week.

If support at SPY $187.50 fails, I will start to buy puts and sell out of the money bearish call spreads.

Look for compressed trading ranges and quiet action for the next week. Focus on day trading and use the first hour range and the guidelines I provided above.

.

.

Daily Bulletin Continues...