Basic Materials Are Weak – Short the Bounce When It Runs Out of Steam

Posted 9:50 AM ET - Two steps up, to steps down. The steps down will be larger in magnitude and the market will have a negative bias. This is the price action I expect to see over the next few weeks. The possibility of a big down day looms, but I don't see that happening ahead of the Unemployment Report.

Bearish markets open on the high and they fade the rest of the day. I believe this early rally will stall and there will be an opportunity to short stocks. My favorite sector to short is basic materials. These stocks are bouncing this morning and there should be a good opportunity for me to enter these trades near the open.

Global economic conditions don't support higher commodity prices. These stocks have rallied due to short covering and central bank money printing. A weak dollar is good for commodities.

After a substantial round of monetary easing, central banks are ready to take their foot off of the gas pedal. The market is addicted to easy money and it won't like hawkish comments.

Earnings season has been okay, but mega cap tech stocks did not provide the spark traders are accustomed to. Stocks are fully priced at a forward P/E of 17 and I don't see leadership in any of the sectors.

Corporate cash flows have decreased and stock repurchase announcements for Q1 are at their lowest level since 2012. This powerful force is missing and the bid to the market has softened.

ISM manufacturing was a little weak and ISM services was better than expected. ADP was light and initial claims increased this week. Tomorrow's Unemployment Report is likely to come in below estimates and that will give the Fed some breathing room.

The QQQ has already broken the 100 day and 200 day moving average. It's hard to imagine the market rally without tech.

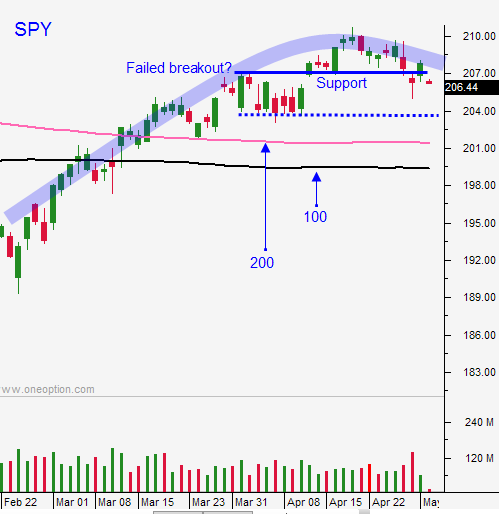

This early market rally should stall and I will be looking for an opportunity to get short today. Support at SPY $207 was breached and yesterday we tested the low from last week ($205). SPY support is at $204 and we could test it tomorrow.

In my comments yesterday, I told you we would see an early bounce and that it would reverse. I waited for that bounce to stall and I made excellent money shorting stocks.

I am long VXX and BZQ overnight. These are bearish positions and they are swing trades.

I will day trade from the short side early today once the market rally stalls. After the first hour I will use that range as my guide.

If the market makes a new low after the first hour of trading, I will get more aggressive with my shorts. I don't want to load up on bearish overnight positions ahead of the Unemployment Report so I will take profits today.

If I see weakness tomorrow and $204 is breached, I will add to my bearish positions with the intent of holding over the weekend.

.

.

Daily Bulletin Continues...