Market Filled With Noise – No Direction and No News – Reduce Your Size

Posted 9:30 AM ET - Market is chopping back and forth during this news vacuum. It lacks pace and direction so keep your activity down in this low probability environment. The next decent round of news will come Monday when China posts GDP/industrial production/retail sales. I'm not expecting a big reaction to these numbers.

This year I've been fading early gaps that are greater than 10 S&P points. Once those moves stall, there is typically a retracement and we look for stocks that are negatively correlated to the market. This strategy has produced fantastic returns and it stopped working this week.

Stocks have gapped higher and the move has held. There is no retracement and we have gradually moved in the direction of the gap the rest of the day. Most of the movement for the day happens in the first 30 minutes. Stocks inch higher and chop around the rest of the day.

Tuesday the market rallied and it got overextended. The retracement that usually would happen intraday came overnight and the SPY gapped down yesterday. Throughout the day, the market drifted downward and it closed on the low. That move did not retrace and it was overextended as well. This morning we are gapping higher.

Fading the opening gaps has not worked this week so I will wait for prices to settle down after an hour before trading. Fading big gaps has worked consistently for many years so I know I just have to avoid trading this pattern for short time.

As always, I will use the first hour range as my guide. If the SPY is above the first hour high, I will focus on longs. If it is below the first hour low, I will focus on shorts. Once the momentum is established for the day, traders don't stand in the way. They support the move run and the retracement comes overnight.

Memorial Day is approaching and holidays typically suck the life out of the market. Earnings season is winding down and the FOMC will not meet until June.

This is a good time to sell credit spreads. I will distance myself from the action and I will take advantage of time decay. Option premiums are relatively cheap so I won't go overboard with this strategy. I don't feel I'm being properly rewarded for the risk and taking. I will sell more bearish call spreads then bullish put spreads because I have a slightly negative bias.

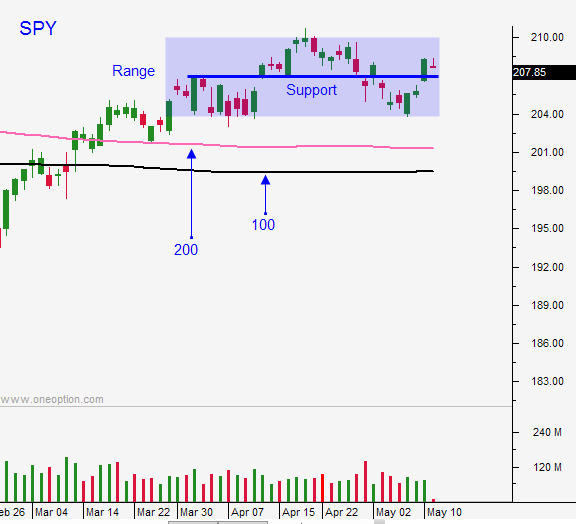

Market support is at SPY $204 and resistance is at $210

The early gap up this morning is likely to hold. Stocks should grind higher the rest of the day.

I suggest reducing your trade count and trimming your size in this low probability trading environment. You don't want to piss your money away when the market has no pace or direction.

Prices are starting to settle in and I would not be surprised to see the market chop around in a 20 point S&P range the next few days.

.

.

Daily Bulletin Continues...